The Trade Reference Form Template You Need to See: Streamlining Business Verification

In the world of business, trust is paramount. Before entering into a new partnership, extending credit, or engaging in any significant transaction, verifying the reliability and payment history of a potential partner is crucial. This is where a trade reference form comes into play. It’s a powerful tool that allows you to gather essential information quickly and efficiently, mitigating risk and fostering confident business decisions.

This article will delve into the importance of trade reference forms, provide insights into the elements of a successful template, and even offer guidance on using them effectively. We’ll equip you with the knowledge you need to navigate this essential aspect of business verification.

Understanding the Importance of a Trade Reference Form

A trade reference form is a structured document used to gather information about a company’s payment history and creditworthiness. It allows you to assess a potential partner’s ability to meet its financial obligations. By requesting this information from other businesses that have experience with the entity in question, you gain valuable insights that can inform your decisions.

Here’s why a well-crafted trade reference form is essential:

- Risk Mitigation: Reduces the likelihood of financial losses due to late payments or defaults.

- Informed Decision-Making: Provides data-driven insights to help you decide whether to extend credit or enter into a business relationship.

- Building Trust: Demonstrates a commitment to due diligence and responsible business practices.

- Preventing Fraud: Helps identify potential red flags and fraudulent activities.

- Streamlined Process: Offers a standardized format for gathering and comparing information, saving time and effort.

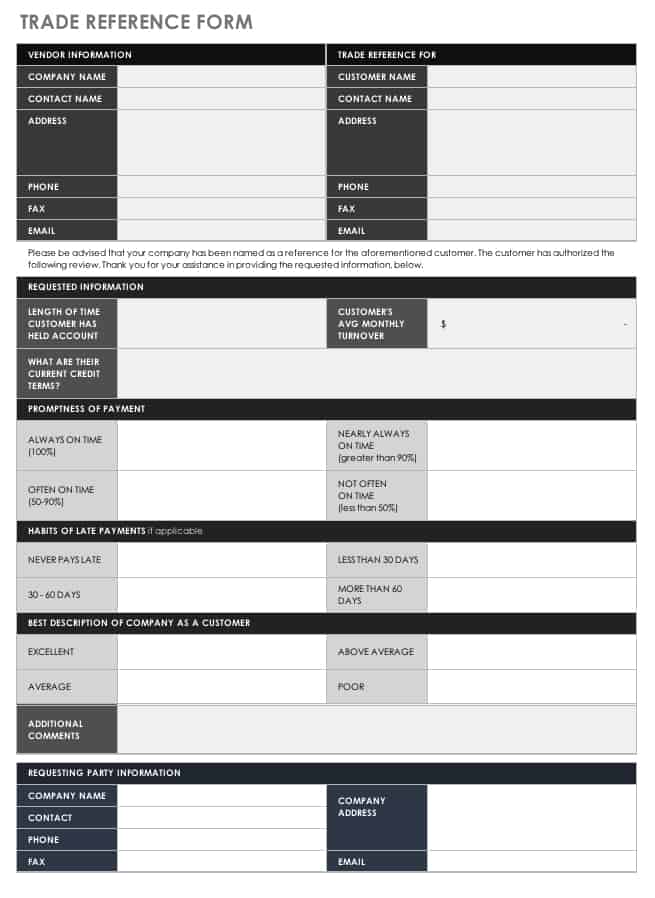

Key Elements of a Powerful Trade Reference Form Template

A robust trade reference form template should be comprehensive yet concise, easy to understand, and designed to elicit the information you need. Here are the key components of an effective template:

- Contact Information:

- Your Company Name and Contact Information (for the requesting party)

- The Name and Contact Information of the Company Being Referenced

- Basic Company Information:

- Company Name

- Address

- Contact Person and Title

- Phone Number

- Email Address

- Website (optional)

- Relationship Details (with the company being referenced):

- How long has the relationship existed?

- What type of business dealings have you had (e.g., supplier, customer)?

- What is the approximate value of the transactions?

- Payment History & Credit Terms:

- What are the agreed-upon payment terms (e.g., net 30, net 60)?

- Does the company pay on time?

- Are there any late payment occurrences? If so, how frequent and by how many days?

- What is the average payment amount?

- What is the highest credit limit extended?

- Overall Assessment:

- Would you recommend doing business with this company?

- Any additional comments or concerns about the company’s payment behavior or financial stability?

- Verification and Authorization:

- Space for the respondent’s signature and date.

- Printed name and title of the respondent.

Pro Tip: Consider including a clear disclaimer stating that the information provided is confidential and will be used solely for the purpose of assessing creditworthiness.

How to Effectively Use Your Trade Reference Form

Once you have a well-structured template, the next step is to use it effectively. Here’s a guide to the process:

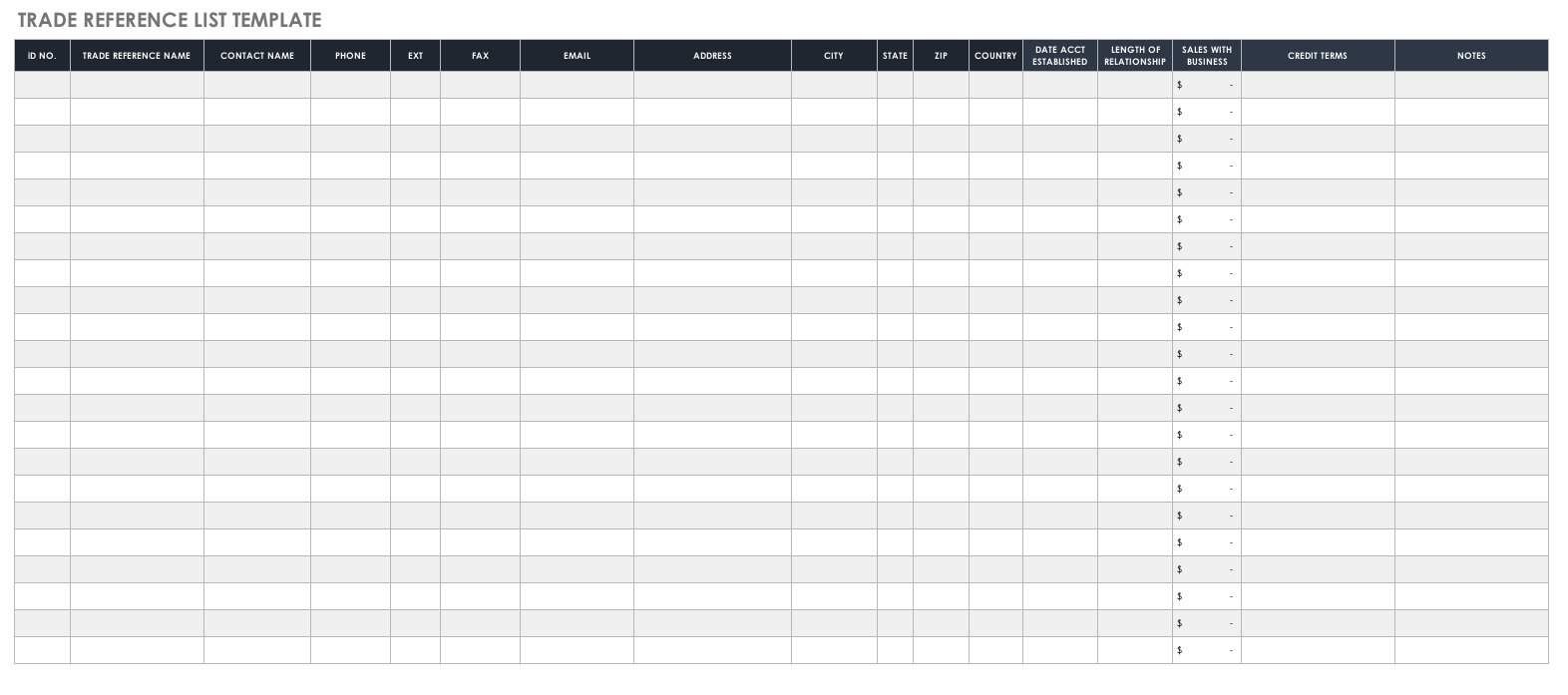

- Identify Potential Trade References: Ask the company seeking credit to provide you with a list of trade references.

- Send the Form: Send the form to the provided references. Consider sending it electronically for faster turnaround.

- Follow Up: Send a gentle follow-up email or phone call to ensure the references complete and return the form.

- Analyze the Information: Carefully review the responses, looking for patterns and inconsistencies.

- Make an Informed Decision: Use the information gathered to assess the company’s creditworthiness and make an informed decision.

- Document Your Findings: Keep a record of the trade reference forms and your analysis for future reference.

Sample Trade Reference Form Template (Simplified)

(This is a simplified example. Adapt it to your specific needs.)

[Your Company Letterhead]

Trade Reference Request

To: [Trade Reference Company Name] From: [Your Company Name]

We are requesting a trade reference for: [Company Name Being Referenced]

Please provide the following information:

- Relationship: [Duration of relationship]

- Payment Terms: [Agreed terms, e.g., Net 30]

- Payment History: [Prompt, Late, Often Late, etc.]

- Average Payment Time: [Days]

- Highest Credit Limit: $[Amount]

- Would you recommend doing business with them? [Yes/No/Maybe]

- Additional Comments: [Space for comments]

Reference Contact: [Name, Title, Phone, Email]

Signature: _________________________ Date: _______________

Thank you for your assistance.

Frequently Asked Questions (FAQs)

1. Can I use a generic trade reference form found online?

While you can find templates online, it’s crucial to customize them to your specific needs and industry. Ensure the form covers all the essential elements mentioned above.

2. How long should I wait for a response from a trade reference?

Give references a reasonable timeframe, typically 7-10 business days. If you haven’t received a response within this period, follow up politely.

3. What if the trade references are reluctant to provide information?

Reassure them that the information will be kept confidential and used solely for assessing creditworthiness. You can also offer to share your own trade references to reciprocate.

4. Is it necessary to obtain trade references for every new client?

The frequency of obtaining trade references depends on your risk tolerance, the size of the transactions, and the nature of your business. For high-value transactions or new clients with limited history, it is highly recommended.

5. Can I use trade references to determine a credit limit?

Yes, trade references are a key factor in determining a suitable credit limit. Analyze the payment history and the highest credit limits extended by other businesses to establish a safe and responsible credit limit.

Conclusion: Empowering Your Business with Informed Decisions

A well-designed and effectively utilized trade reference form is an invaluable asset for any business. By understanding its importance, incorporating the right elements, and implementing a clear process, you can significantly reduce your financial risk, make informed decisions, and build stronger, more reliable business relationships. Take the time to create or adapt a template that meets your specific needs and start leveraging the power of trade references today. You’ll be well on your way to building a more secure and successful business.