The Sample Credit Application Form Australia You Need for Your Business

Securing payment for goods or services is crucial for any business in Australia. Offering credit terms can attract more customers and boost sales, but it also introduces the risk of non-payment. A well-crafted credit application form is the first line of defense, providing you with essential information to assess creditworthiness and minimize potential financial losses. This article provides a comprehensive guide to understanding and implementing the ideal sample credit application form for your Australian business, ensuring you’re equipped to make informed credit decisions.

Why a Credit Application Form is Essential

Before extending credit, you need to understand the financial standing of your potential customer. A credit application form acts as a formal request for credit, allowing you to gather vital information about the applicant. It’s not just a form; it’s a crucial risk management tool.

Here’s why a well-designed credit application form is essential:

- Assesses Creditworthiness: Provides data to evaluate the applicant’s ability to repay debts.

- Mitigates Risk: Helps identify potential high-risk customers and allows you to set appropriate credit limits or terms.

- Legal Protection: Serves as a legally binding agreement, outlining the terms of credit and providing recourse in case of non-payment.

- Streamlines the Process: Standardizes the credit application process, saving time and effort.

- Enforces Terms and Conditions: Clearly communicates your payment expectations and late payment penalties.

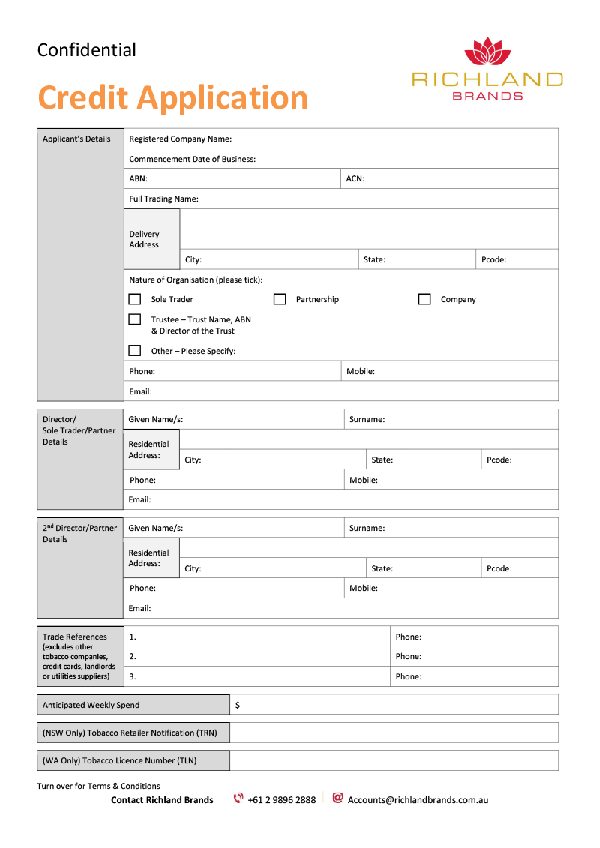

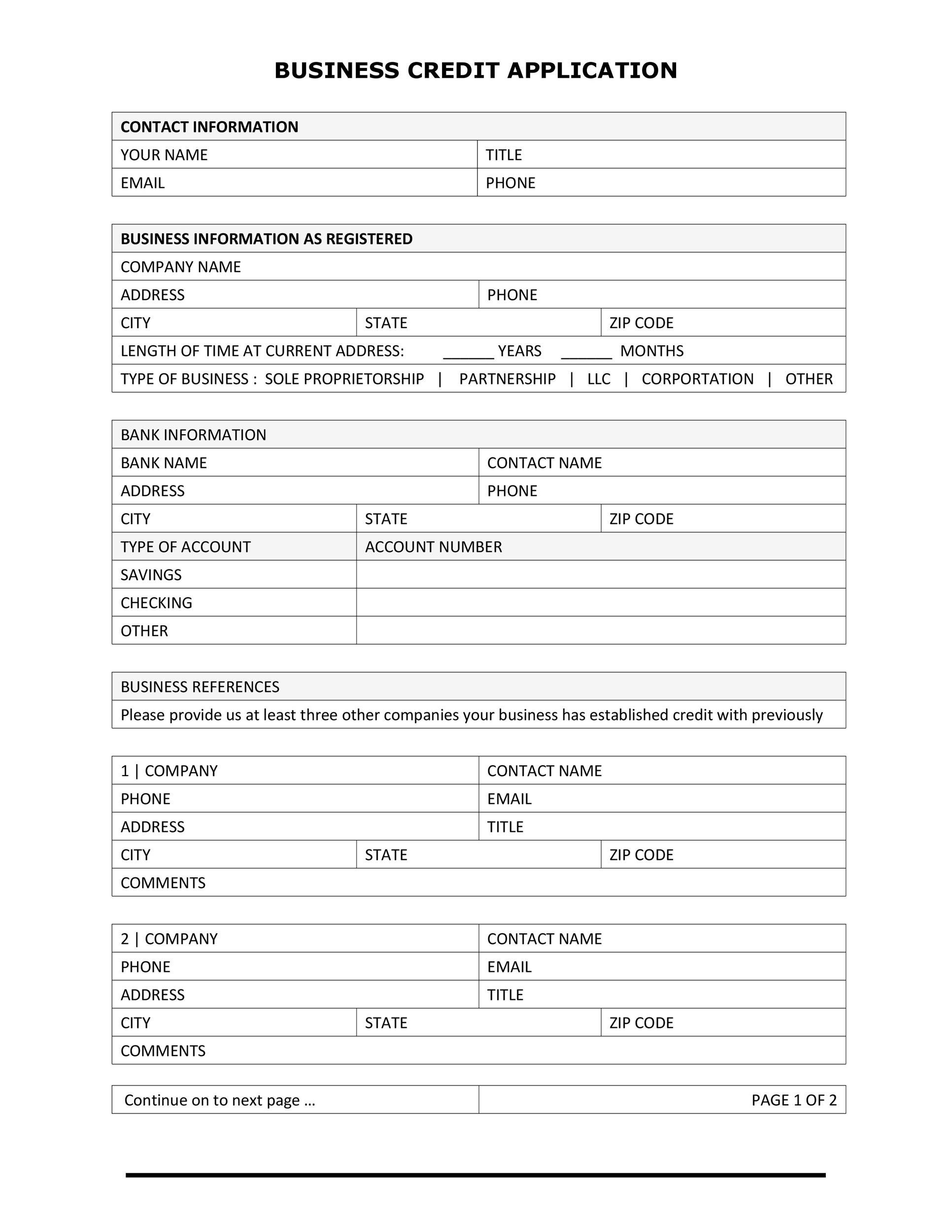

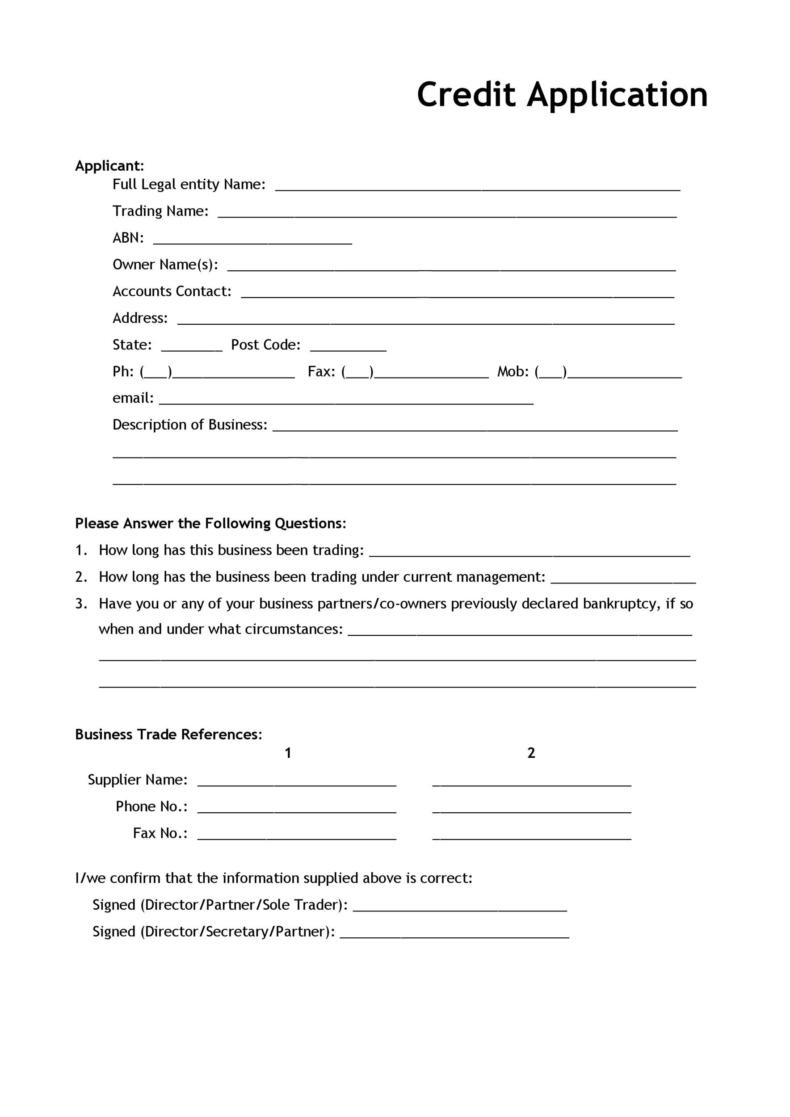

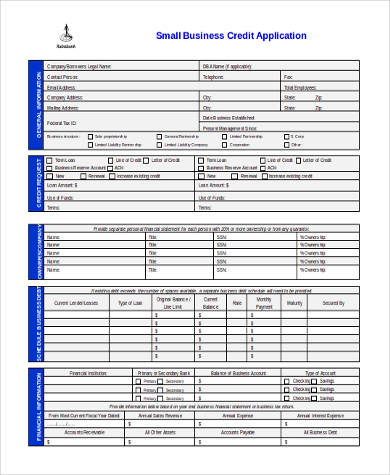

Key Components of an Australian Credit Application Form

An effective credit application form should be clear, concise, and comprehensive. It should gather the necessary information without being overly burdensome for the applicant. Here are the essential sections to include:

Applicant Information

- Business Name: (Including ABN/ACN) This is crucial for verifying the business’s legitimacy.

- Business Address: Physical address is important for correspondence and potential legal action.

- Contact Person & Title: Specifies who to contact regarding the account.

- Phone Number & Email Address: For quick communication.

- Website (if applicable): Provides additional information about the business.

- Legal Structure: (e.g., Sole Trader, Partnership, Company) This helps determine liability.

Financial Information

- Bank Details: Bank name, branch, account name, and BSB/account number for direct debit or other payment methods.

- Trade References: Contact details for at least two or three existing suppliers. This is vital for checking the applicant’s payment history.

- Financial Statements (optional, but recommended for larger credit limits): May include balance sheets, profit and loss statements, or tax returns.

Credit Terms and Conditions

- Credit Limit Requested: The maximum amount of credit the applicant is seeking.

- Payment Terms: Clearly state the payment due date (e.g., 30 days from invoice date).

- Late Payment Penalties: Include details of any late payment fees or interest charges.

- Security Interest (if applicable): If you’re taking a security interest (e.g., retention of title), this section should clearly outline the terms.

- Personal Guarantee (for sole traders and partnerships): If required, include a section for personal guarantors to sign.

- Privacy Clause: Comply with the Australian Privacy Principles by including a statement about how you handle personal information.

Declaration and Signature

- Applicant’s Declaration: A statement confirming the accuracy of the information provided.

- Authorization: A space for the applicant to authorize you to conduct credit checks and contact their references.

- Signature & Date: A signed and dated application is crucial for legal enforceability.

Tips for Designing Your Credit Application Form

- Keep it Clear and Concise: Use plain language and avoid jargon.

- Make it Easily Accessible: Offer both online and printable versions.

- Use a Professional Design: Ensure the form is visually appealing and easy to read.

- Seek Legal Advice: Have a legal professional review your form to ensure it complies with all relevant Australian laws and regulations.

- Regularly Review and Update: Review your form periodically to ensure it remains relevant and effective.

Where to Find a Sample Credit Application Form Australia

You can find sample credit application forms in several places:

- Legal Websites: Many legal websites offer downloadable templates.

- Business Resources: Business Australia or your local Chamber of Commerce may provide templates.

- Accounting Software Providers: Some accounting software platforms offer credit application templates.

- Online Templates: Search online using terms like “Sample Credit Application Form Australia” to find various examples. Remember to tailor the template to your specific business needs.

Processing and Approving Credit Applications

Once you receive an application, follow these steps:

- Verify Information: Check ABN/ACN, contact references, and review financial statements.

- Conduct Credit Checks (optional): Consider using a credit reporting agency.

- Assess Creditworthiness: Evaluate the applicant’s ability to meet your payment terms.

- Communicate Decision: Notify the applicant of the outcome and the approved credit limit (if applicable).

- Maintain Records: Keep a record of all applications, approvals, and denials.

Conclusion

A well-designed credit application form is a vital asset for any Australian business offering credit terms. By carefully crafting your form and implementing a robust credit assessment process, you can minimize financial risk, protect your business, and foster positive customer relationships. Remember to tailor the form to your specific business needs, seek legal advice, and regularly review and update the form to ensure its effectiveness.

FAQs

1. Is a credit application form legally required in Australia?

While there’s no specific law mandating a credit application form, it is highly recommended as a crucial part of your risk management strategy and provides legal protection in case of non-payment.

2. Can I use a standard template, or do I need a custom form?

You can start with a standard template, but it’s crucial to customize it to reflect your business’s specific needs, credit terms, and legal requirements.

3. How long should I keep credit application records?

The retention period for credit application records varies, but it is generally recommended to keep them for at least seven years, in line with Australian tax regulations. This is important for potential legal disputes and audits.

4. What if a customer doesn’t fill out all the fields on the application?

If a customer doesn’t complete all required fields, you may need to contact them for clarification. If the missing information is critical for assessing creditworthiness, you may need to decline the application.

5. Should I charge a fee for processing a credit application?

It is generally not common practice to charge a fee for processing a credit application in Australia, particularly for small-to-medium sized businesses.