Taming Your Finances: The Monthly Expense Monthly Budget Planner Template That Works

Feeling overwhelmed by where your money goes each month? Do you find yourself constantly wondering, “Where did it all go?” You’re not alone. Millions struggle to effectively manage their finances, often leading to stress and missed financial goals. The good news is that taking control is entirely possible, and it starts with a simple yet powerful tool: a monthly expense monthly budget planner template.

This article will guide you through understanding the benefits of using a budget planner template, how to select the right one, and how to effectively implement it to achieve financial clarity and success. We’ll delve into the key components, offer practical tips, and address common questions to empower you on your budgeting journey.

Why Use a Monthly Expense Monthly Budget Planner Template?

A budget planner template is more than just a spreadsheet or a piece of paper; it’s your financial command center. It’s a structured system designed to help you understand your income, track your expenses, and ultimately, control your spending. Here’s why a well-designed template is invaluable:

- Increased Financial Awareness: It forces you to confront your spending habits head-on, revealing where your money is truly going.

- Improved Spending Control: By visually tracking your expenses against your budget, you can identify areas where you’re overspending and make informed adjustments.

- Goal Setting and Achievement: A budget allows you to allocate funds towards your financial goals, whether it’s saving for a down payment, paying off debt, or investing for the future.

- Reduced Financial Stress: Knowing where your money is going provides a sense of control, reducing anxiety and promoting financial peace of mind.

- Simplified Tracking and Analysis: Templates, especially digital ones, automate calculations, making it easier to analyze your spending patterns over time.

Choosing the Right Monthly Expense Monthly Budget Planner Template

The market is flooded with budgeting tools, from simple spreadsheets to sophisticated apps. Choosing the right template depends on your individual needs and preferences. Consider these options:

Spreadsheet Templates (Excel, Google Sheets):

- Pros: Highly customizable, readily available, free or low-cost, allows for detailed tracking and analysis.

- Cons: Requires some technical knowledge, can be time-consuming to set up initially.

- Good for: Individuals who want complete control and customization.

Budgeting Apps (Mint, YNAB, Personal Capital):

- Pros: Automated expense tracking (linking to bank accounts), user-friendly interfaces, some offer investment tracking.

- Cons: Can be subscription-based, may have limited customization options, potential privacy concerns.

- Good for: Those who prefer automation and ease of use.

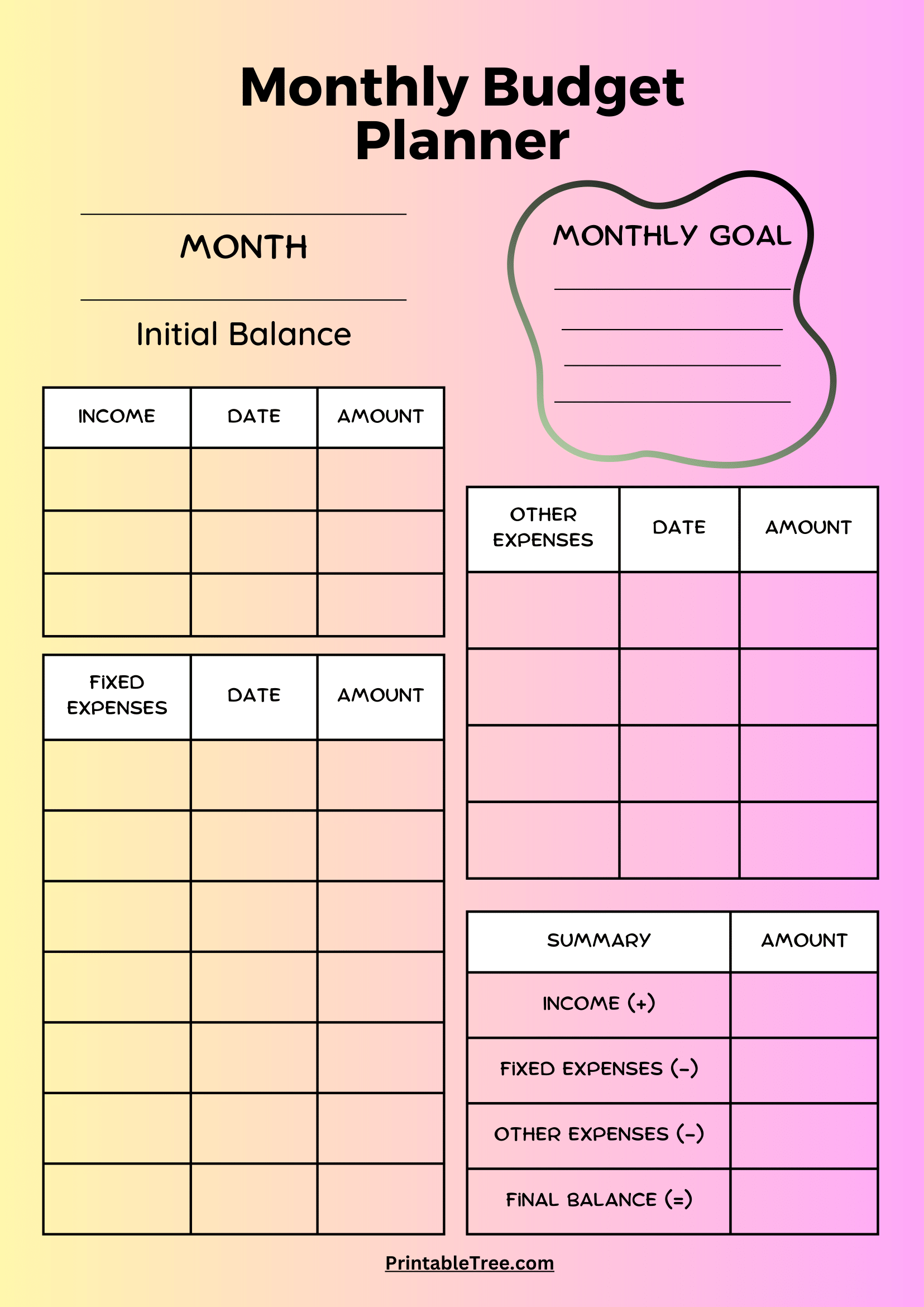

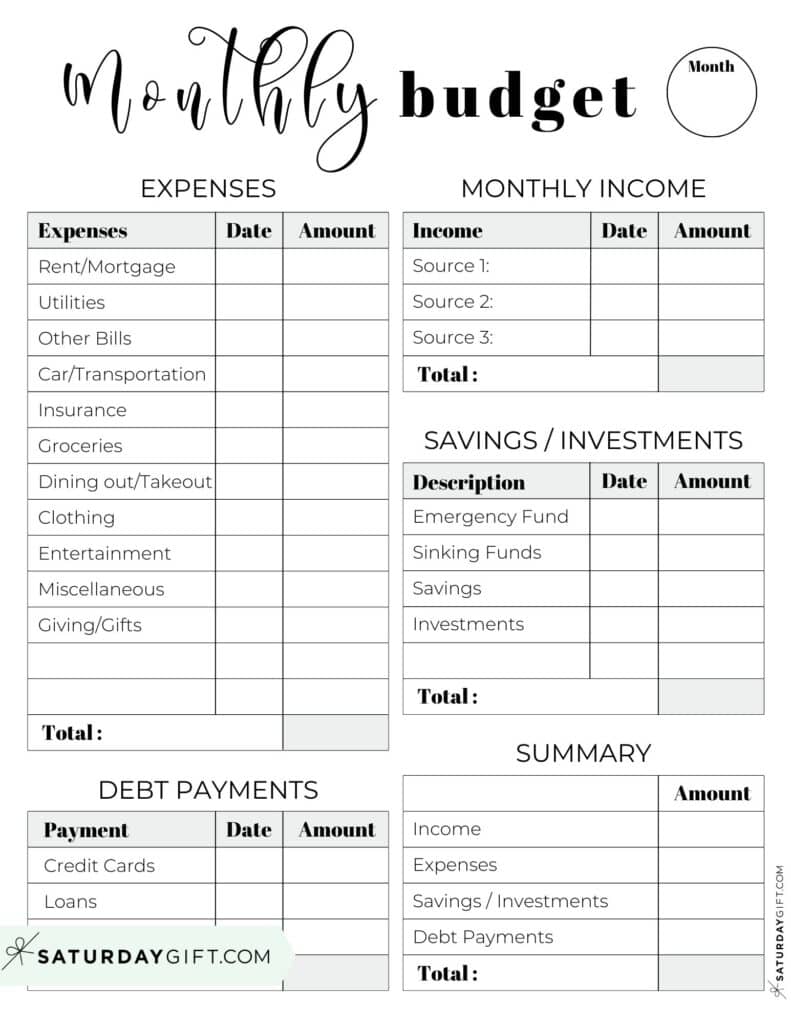

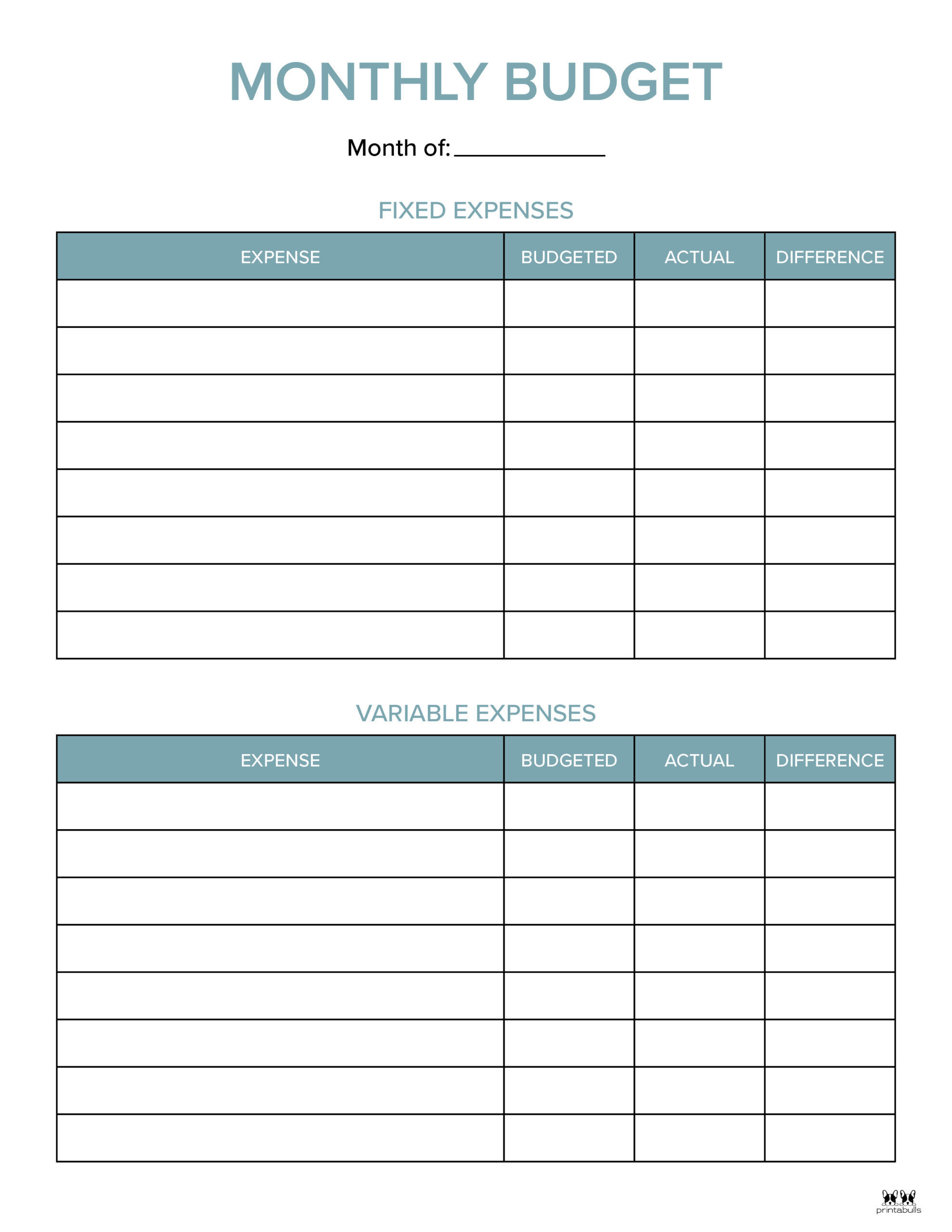

Printable Budget Templates:

- Pros: Simple, no technical skills required, good for visual learners.

- Cons: Requires manual data entry, less flexible than digital options, prone to errors.

- Good for: Individuals who prefer a tangible approach to budgeting.

Key Features to Look For in a Template:

- Income Tracking: Clearly defined sections for recording all income sources.

- Expense Categories: Well-defined categories for tracking both fixed and variable expenses (housing, transportation, food, entertainment, etc.).

- Budget Allocation: A clear space to set budget amounts for each expense category.

- Actual Spending Tracking: Columns to record your actual spending against your budgeted amounts.

- Variance Analysis: The ability to see the difference between your budget and your actual spending, highlighting areas for improvement.

- Summarization: Provides a clear overview of your income, expenses, and overall financial performance.

Implementing Your Monthly Expense Monthly Budget Planner Template: A Step-by-Step Guide

Once you’ve chosen your template, follow these steps for effective implementation:

- Gather Your Financial Information: Collect your income statements, bank statements, and credit card bills from the previous month.

- Set Your Budget: Determine your income and allocate funds to each expense category. Be realistic and prioritize your financial goals.

- Track Your Expenses: Record every expense throughout the month. Be diligent and accurate.

- Review and Analyze: At the end of the month, compare your actual spending to your budget. Identify areas where you overspent or underspent.

- Adjust and Refine: Based on your analysis, adjust your budget for the next month. Continue to refine your budgeting strategy over time.

- Automate Where Possible: Utilize online banking and budgeting apps to automate expense tracking and bill payments.

Tips for Success: Making Your Budget Stick

- Be Realistic: Don’t set unrealistic budget goals that are impossible to achieve.

- Start Small: Begin with a simple budget and gradually add more complexity as you become more comfortable.

- Track Every Expense: Consistency is key. Make it a habit to record every purchase, no matter how small.

- Review Regularly: Set aside time each week to review your budget and make adjustments as needed.

- Be Patient: Budgeting takes time and practice. Don’t get discouraged if you don’t see results immediately.

- Reward Yourself: Acknowledge your successes and celebrate your progress.

Frequently Asked Questions (FAQs)

Q1: How often should I update my budget template?

A1: Ideally, you should update your template daily or weekly to stay on top of your spending. At a minimum, review and update it at least once a week.

Q2: What if I overspend in a particular category?

A2: Don’t panic! Analyze why you overspent. Can you cut back in another category to compensate? Adjust your budget for the following month to prevent overspending in that area again.

Q3: How do I budget for irregular expenses?

A3: Create a “sinking fund” for irregular expenses such as car maintenance, holiday gifts, or annual subscriptions. Divide the total cost by the number of months until the expense is due, and save that amount each month.

Q4: Is it necessary to track every single penny?

A4: While it’s ideal to track all expenses, focus on the categories where you spend the most. If you’re comfortable, you can simplify tracking smaller, less significant expenses.

Q5: What if my income fluctuates each month?

A5: Base your budget on your lowest expected income. Any extra income can be allocated toward savings, debt repayment, or discretionary spending.

Conclusion

A monthly expense monthly budget planner template is a powerful tool for taking control of your finances. By choosing the right template, implementing it consistently, and adapting your approach over time, you can gain financial clarity, achieve your goals, and reduce financial stress. Start today, and take the first step towards a brighter financial future!