The Job Order Cost Sheet Template in Excel You’ll Ever Need: Streamline Your Manufacturing Costs

In the dynamic world of manufacturing, accurately tracking and managing costs is crucial for profitability and informed decision-making. A well-designed job order cost sheet is the cornerstone of this process, providing a detailed breakdown of all expenses associated with a specific project or job. This article will guide you through the importance of job order costing and provide you with the essential elements of a powerful Excel template to help you take control of your production costs.

Understanding Job Order Costing and Its Importance

Job order costing is a cost accounting method used to track the costs associated with individual jobs, projects, or batches of products. Unlike process costing, which averages costs across a continuous production flow, job order costing provides a granular view of expenses. This is especially vital for businesses that:

- Produce customized products.

- Handle unique projects with varying requirements.

- Need to bid on jobs accurately.

- Require detailed cost analysis for each order.

By implementing effective job order costing, you can:

- Accurately Determine Product Costs: Understand the true cost of each job, enabling you to set competitive prices and maximize profit margins.

- Control and Reduce Costs: Identify areas of inefficiency and potential cost savings by analyzing the components of each job.

- Improve Pricing Strategies: Use historical cost data to create more accurate bids and proposals for future projects.

- Enhance Decision-Making: Make informed decisions about product design, resource allocation, and process improvement based on reliable cost information.

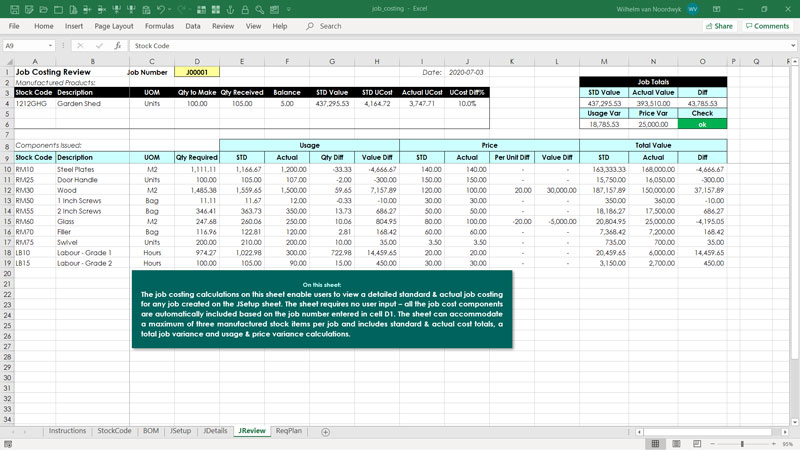

Key Elements of an Effective Job Order Cost Sheet Template in Excel

Creating a robust Excel template is key to simplifying the job order costing process. Here’s a breakdown of the essential elements:

1. Header Information:

- Job Order Number: A unique identifier for each job.

- Job Description: A brief overview of the project.

- Customer Name: The client for whom the job is being completed.

- Date Opened/Date Closed: Tracking the job’s lifecycle.

- Prepared By/Approved By: Identifying responsible parties.

2. Direct Materials Costs:

- Material Name: The specific raw materials used.

- Quantity: The amount of each material consumed.

- Unit Cost: The cost per unit of each material.

- Total Material Cost: Calculated automatically (Quantity x Unit Cost).

- Purchase Orders (Optional): Link to relevant purchase orders for auditing.

3. Direct Labor Costs:

- Employee Name/Labor Category: The personnel involved.

- Hours Worked: The time spent on the job.

- Hourly Rate: The wage per hour.

- Total Labor Cost: Calculated automatically (Hours Worked x Hourly Rate).

4. Manufacturing Overhead Costs:

- Overhead Allocation Method: (e.g., Machine hours, Direct labor hours, Direct labor cost)

- Overhead Rate: Calculated based on a predetermined overhead rate.

- Overhead Applied: Calculated automatically based on the allocation method. (e.g., Machine Hours x Overhead Rate)

- Examples of Overhead Costs: Rent, utilities, depreciation, indirect materials.

5. Cost Summary and Analysis:

- Total Direct Materials Cost: Sum of all direct material costs.

- Total Direct Labor Cost: Sum of all direct labor costs.

- Total Manufacturing Overhead Applied: Calculated overhead.

- Total Job Cost: Sum of all direct material, direct labor, and manufacturing overhead costs.

- Cost per Unit (Optional): Total Job Cost divided by the number of units produced.

- Profit/Loss (Optional): Comparison of Total Job Cost and Revenue.

6. Automation and Formulas:

- Use Excel Formulas: Utilize formulas (SUM, PRODUCT, etc.) to automate calculations.

- Conditional Formatting: Highlight cells that exceed predetermined cost thresholds.

- Data Validation: Ensure accurate data entry (e.g., drop-down lists for material names).

Building Your Excel Template: A Step-by-Step Guide

- Set Up the Header: Create the header section with the information outlined above.

- Direct Materials Section: Design a table with columns for Material Name, Quantity, Unit Cost, and Total Material Cost. Use the

PRODUCTformula to calculate the total cost. - Direct Labor Section: Create a table with Employee Name/Labor Category, Hours Worked, Hourly Rate, and Total Labor Cost. Use the

PRODUCTformula for the total labor cost. - Manufacturing Overhead Section: Include your overhead allocation method, overhead rate, and applied overhead. Apply the appropriate formulas based on your chosen method.

- Cost Summary: Create a section to summarize the totals for materials, labor, and overhead. Use the

SUMformula to total the costs. - Cost per Unit and Profit/Loss (Optional): Add sections to calculate these metrics if desired.

- Formatting: Use clear formatting, including borders, fonts, and color-coding, to make the template easy to read and use.

- Data Validation: Implement data validation to ensure accurate data entry.

- Testing: Thoroughly test the template with sample data to ensure all formulas work correctly.

Benefits of Using a Job Order Cost Sheet Template in Excel

- Efficiency: Saves time and reduces manual calculations.

- Accuracy: Minimizes errors and provides reliable cost data.

- Organization: Provides a structured format for tracking costs.

- Flexibility: Easily customized to meet specific business needs.

- Accessibility: Excel is widely available and easy to use.

Conclusion: Empower Your Manufacturing with a Powerful Costing Tool

Implementing a well-designed Job Order Cost Sheet Template in Excel is a vital step towards effective cost management and improved profitability in your manufacturing operations. By understanding the key elements and building a customized template, you can gain valuable insights into your production costs, make informed decisions, and ultimately drive your business towards success. This template is your essential tool to help you succeed in today’s competitive market.

Frequently Asked Questions (FAQs)

1. What is the difference between job order costing and process costing?

Job order costing tracks costs for individual jobs or projects, ideal for customized products. Process costing averages costs across continuous production flows, suitable for mass-produced, homogenous goods.

2. How do I determine my manufacturing overhead rate?

The overhead rate is typically calculated by dividing total estimated overhead costs for a period (e.g., a year) by a predetermined allocation base (e.g., direct labor hours, machine hours, or direct labor cost) for that same period.

3. Can I automate the template further?

Yes, you can expand the template by:

- Linking it to your accounting software.

- Using VBA (Visual Basic for Applications) to create macros for automated reporting and data import.

- Integrating the template with your inventory management system.

4. What are some common overhead costs?

Common overhead costs include factory rent, utilities, depreciation on factory equipment, factory insurance, indirect materials, and salaries of factory supervisors.

5. Is there a free Job Order Cost Sheet template available?

Yes, there are many free job order cost sheet templates available online. Search for “free job order cost sheet excel template” to find options. Be sure to tailor any template to fit your specific business needs.