The Certificate of Good Standing PRC Sample You Need to See: A Comprehensive Guide

Navigating the complexities of business registration and compliance can feel overwhelming, especially when dealing with legal documents. If you’re a business operating or planning to operate in the Philippines, or if you’re dealing with a Philippine-registered entity, you’ve likely encountered the term “Certificate of Good Standing.” This crucial document, issued by the Securities and Exchange Commission (SEC) in the Philippines, confirms that a company is in good legal standing and has met its regulatory requirements. This article provides a comprehensive overview of the Certificate of Good Standing, including a sample you can use as a reference. We’ll break down its purpose, content, and how it impacts your business.

Understanding the Certificate of Good Standing in the Philippines

A Certificate of Good Standing, often referred to as a “Certificate of Compliance” or simply “Good Standing Certificate,” is an official document issued by the Philippine SEC. It essentially serves as a seal of approval, verifying that a company is:

- Currently registered and active with the SEC.

- Up-to-date with its mandatory reporting requirements, such as the General Information Sheet (GIS) and annual financial statements.

- Has not been suspended or revoked.

This certificate is a critical piece of documentation for various business activities.

What is the Purpose of a Certificate of Good Standing?

The Certificate of Good Standing serves several vital purposes, making it essential for businesses operating in the Philippines. It is often required for:

- Business Transactions: Banks, financial institutions, and other businesses often require a Certificate of Good Standing to verify a company’s legitimacy and compliance before entering into significant agreements.

- Legal Proceedings: It can be required as evidence of a company’s valid existence in legal proceedings.

- Permit Applications: Local government units might request this certificate when applying for business permits and licenses.

- Foreign Investment: Foreign investors often require this document to ensure the Philippine entity they are dealing with is in good standing.

- Tender Bids: Participating in government or private tenders often necessitates the submission of a Certificate of Good Standing.

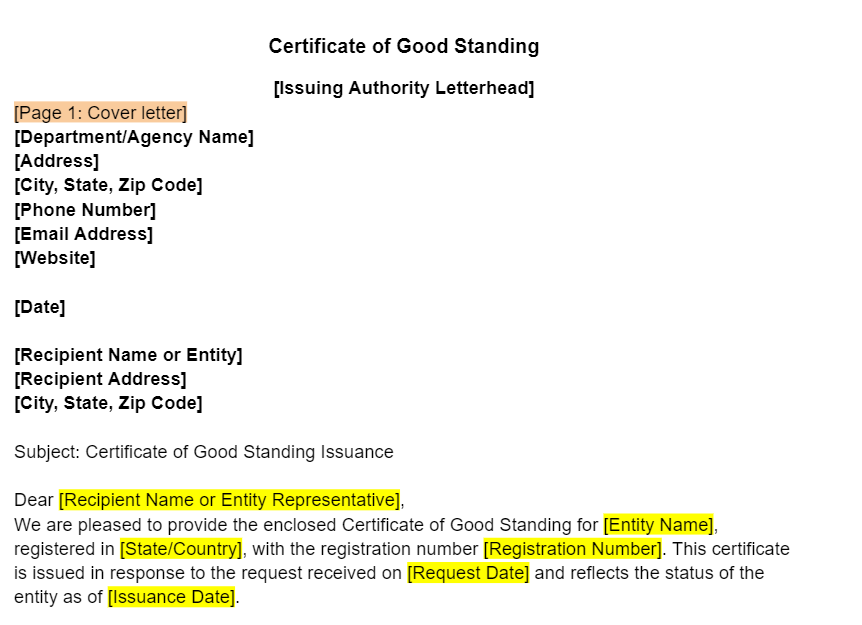

Key Elements of a Certificate of Good Standing PRC Sample

While the specific format may vary slightly, a typical Certificate of Good Standing from the SEC Philippines will include the following key elements:

- Official SEC Letterhead: Usually includes the SEC logo and address.

- Certificate Title: Clearly states “Certificate of Good Standing” or a similar title.

- Company Information:

- Registered Company Name

- SEC Registration Number

- Date of Incorporation

- Registered Office Address

- Statement of Good Standing: A clear declaration confirming the company’s current good standing status. This will usually state that the company is “existing and has complied with the requirements of the law.”

- Compliance Verification: Details about the company’s compliance with reporting requirements (e.g., GIS filing, annual financial statement submission).

- Date of Issuance: The date the certificate was issued.

- Signature and Seal: The official signature of an authorized SEC officer, along with the SEC official seal.

- Validity Period: While not always explicitly stated, the certificate is generally valid for a limited period.

Sample Certificate of Good Standing (Conceptual)

(OFFICIAL LETTERHEAD OF THE SECURITIES AND EXCHANGE COMMISSION)

CERTIFICATE OF GOOD STANDING

Date of Issuance: October 26, 2023

TO WHOM IT MAY CONCERN:

This is to certify that [COMPANY NAME], a corporation duly organized and existing under the laws of the Republic of the Philippines, with SEC Registration Number [SEC REGISTRATION NUMBER] and with its registered office at [REGISTERED OFFICE ADDRESS], is in good standing with this Commission as of this date.

[COMPANY NAME] was registered on [DATE OF INCORPORATION] and has complied with the requirements of the law, including the submission of its General Information Sheets (GIS) and its annual financial statements.

This Certificate is issued upon request.

IN WITNESS WHEREOF, I have hereunto set my hand and caused the seal of the Securities and Exchange Commission to be affixed this [DAY] day of [MONTH], [YEAR].

(Signature of Authorized SEC Officer)

(Official Seal of the Securities and Exchange Commission)

Please Note: This is a conceptual sample. The actual format and content may vary. It is crucial to consult the official SEC website or contact the SEC directly for the most up-to-date information and a valid sample.

How to Obtain a Certificate of Good Standing

Obtaining a Certificate of Good Standing typically involves the following steps:

- Check Compliance: Ensure your company is up-to-date with its reporting requirements (GIS, annual financial statements, etc.) through the SEC’s online portal or by contacting the SEC directly.

- Prepare the Application: Fill out the necessary application form, which can usually be downloaded from the SEC website or obtained from their office.

- Pay the Fees: Pay the required fees, as determined by the SEC.

- Submit the Application: Submit the completed application form and proof of payment to the SEC. This can often be done online, through mail, or in person at a SEC office.

- Receive the Certificate: The SEC will process your application and issue the Certificate of Good Standing if your company meets the requirements. Processing times can vary.

Important Considerations

- Validity: Certificates typically have a limited validity period. Always check the date of issuance and the intended use to ensure the certificate is current.

- Amendments: Any changes to your company’s information (e.g., address, officers) should be updated with the SEC. This can affect your eligibility for a Certificate of Good Standing.

- Professional Assistance: If you’re unsure about the process or requirements, consider seeking professional assistance from a lawyer or a company specializing in corporate compliance.

Frequently Asked Questions (FAQs)

1. How long is a Certificate of Good Standing valid?

The validity period is not always explicitly stated on the certificate. However, it is generally considered valid for a reasonable period, typically a few months. It’s best to check with the requesting party to determine their specific requirements.

2. What happens if my company is not in good standing?

If your company is not in good standing (e.g., due to non-compliance with reporting requirements), you will not be able to obtain a Certificate of Good Standing. You must rectify the issues, such as filing overdue reports, to become compliant.

3. Where can I download the application form for a Certificate of Good Standing?

The application form is usually available for download on the official website of the Securities and Exchange Commission (SEC) Philippines. You can also obtain the form from the SEC’s offices.

4. Can I get a Certificate of Good Standing online?

Yes, the SEC generally offers online application and processing options for Certificates of Good Standing. Check the SEC website for the latest information on their online services.

5. What are the fees associated with obtaining a Certificate of Good Standing?

The fees vary and are determined by the SEC. These fees are subject to change, so it is best to check the current fee schedule on the SEC website or contact them directly.

Conclusion

The Certificate of Good Standing is a crucial document for businesses operating in the Philippines. Understanding its purpose, content, and the process of obtaining it is essential for maintaining compliance and facilitating various business activities. By familiarizing yourself with the requirements and the sample provided, you can ensure your company is in good standing and ready to meet its legal and regulatory obligations. Always refer to the official SEC website for the most accurate and up-to-date information.