The Car Installment Payment Contract Template in PDF You Need: Securing Your Vehicle Purchase

Buying a car is a significant financial commitment. Whether you’re purchasing from a dealership or a private seller, the details of your payment plan need to be crystal clear and legally sound. A well-crafted car installment payment contract is the cornerstone of this process, outlining the terms of your purchase and protecting both the buyer and the seller. This article provides a comprehensive guide to understanding and utilizing a car installment payment contract template in PDF format, ensuring a smooth and secure vehicle transaction.

Why You Need a Car Installment Payment Contract

A car installment payment contract, also known as a vehicle purchase agreement or installment sale agreement, is a legally binding document that details the terms of your car purchase when payments are made over time. It’s essential because it:

- Defines the Payment Schedule: Clearly outlines the amount of each payment, the due date, and the total number of payments.

- Specifies the Vehicle Details: Includes a comprehensive description of the car, including the VIN (Vehicle Identification Number), make, model, year, and any included features.

- Protects Both Parties: Sets forth the rights and responsibilities of both the buyer and the seller, minimizing the risk of disputes.

- Outlines Default and Remedies: Specifies what happens if the buyer fails to make payments, including potential repossession procedures.

- Provides Legal Clarity: Serves as a legally enforceable agreement in case of disagreements.

Key Elements of a Car Installment Payment Contract Template in PDF

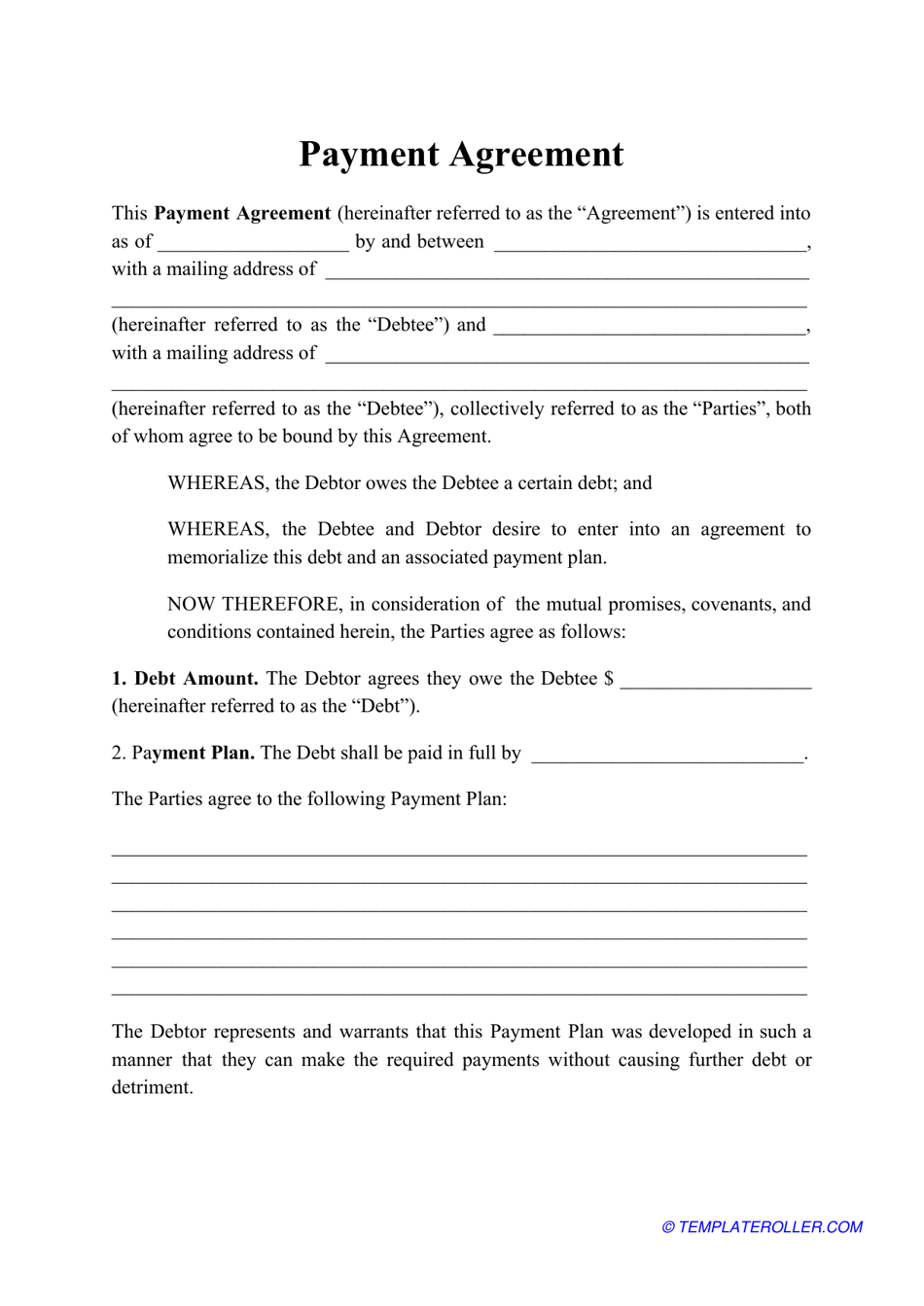

A well-structured car installment payment contract template in PDF format should contain the following crucial elements:

- Parties Involved: The full legal names and contact information of the buyer (borrower) and the seller (lender).

- Vehicle Description: A detailed description of the car, including:

- Make, Model, and Year

- VIN (Vehicle Identification Number)

- Mileage

- Condition (e.g., “As-Is” or warrantied)

- Included Accessories

- Purchase Price: The agreed-upon selling price of the vehicle.

- Down Payment: The amount paid upfront, if any.

- Amount Financed: The total amount the buyer is financing.

- Interest Rate: The annual percentage rate (APR) charged on the loan.

- Payment Schedule:

- Payment Amount

- Payment Frequency (e.g., monthly)

- Payment Due Date

- Number of Payments

- Total Amount Paid

- Late Payment Penalties: Details about late payment fees.

- Default and Repossession: The conditions under which the seller can repossess the vehicle if the buyer defaults on payments.

- Security Interest: Information about the seller’s right to the vehicle until the loan is fully paid.

- Insurance Requirements: Any requirements for the buyer to maintain car insurance.

- Governing Law: The state law that governs the contract.

- Signatures: Spaces for both the buyer and seller to sign and date the agreement.

Finding and Using a Car Installment Payment Contract Template in PDF

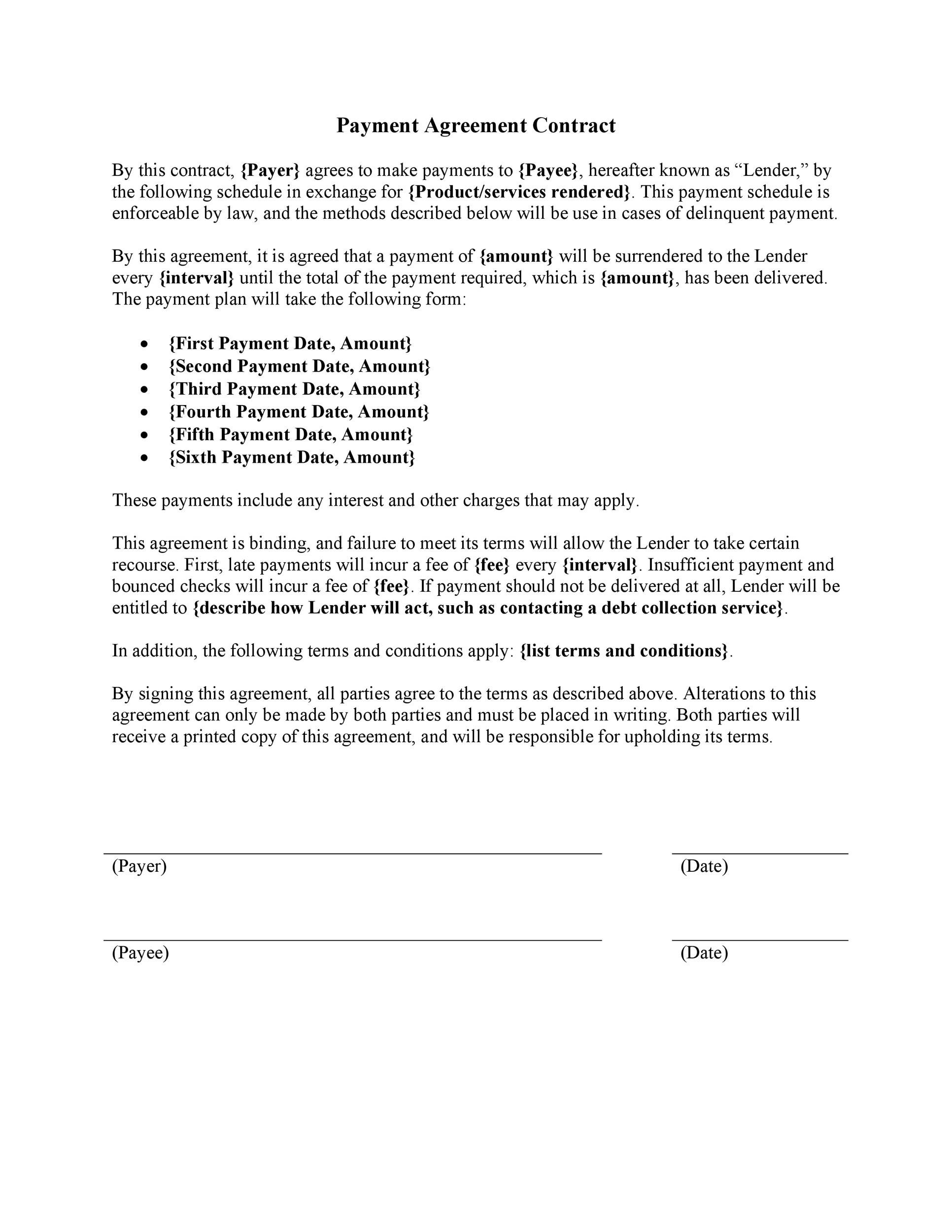

Numerous resources offer car installment payment contract templates in PDF format. Here’s how to find and utilize them effectively:

- Online Legal Document Providers: Websites like LegalZoom, Rocket Lawyer, and DocuSign offer customizable legal document templates, including car installment contracts. These often come with guidance and legal reviews.

- Free Template Websites: Search online for “car installment payment contract template PDF free.” However, always carefully review the template and ensure it meets your specific needs and adheres to your state’s laws. Be cautious of the source and ensure the template is from a reputable provider.

- Download and Customize: Once you find a suitable template, download it as a PDF. Open the PDF using a PDF editor (like Adobe Acrobat Reader or a free online PDF editor) and fill in all the required information accurately.

- Review and Legal Advice: Before signing the contract, both the buyer and seller should carefully review all terms. Consider seeking legal advice from an attorney to ensure the contract adequately protects your interests and complies with all applicable laws.

- Printing and Signing: After reviewing and finalizing the contract, print two copies. Both the buyer and seller should sign and date both copies. Each party keeps a signed copy for their records.

Important Considerations Before Signing

Before signing a car installment payment contract, consider these crucial points:

- Negotiate the Terms: Don’t be afraid to negotiate the interest rate, down payment, and other terms of the agreement.

- Read the Fine Print: Carefully read all the clauses, including those related to late payments, default, and repossession.

- Verify the Vehicle’s History: Obtain a vehicle history report (e.g., Carfax or AutoCheck) to check for accidents, damage, and title issues.

- Inspect the Vehicle: Thoroughly inspect the car before signing the contract. Consider having a mechanic inspect it.

- Understand Your Rights: Familiarize yourself with your rights as a buyer under your state’s consumer protection laws.

Conclusion: Secure Your Car Purchase with a Solid Contract

A car installment payment contract template in PDF is an indispensable tool for anyone financing a vehicle purchase. By utilizing a comprehensive and well-crafted template, both buyers and sellers can protect their interests, clarify the terms of the agreement, and minimize the risk of disputes. Remember to carefully review all terms, seek legal advice if needed, and prioritize a secure and legally sound transaction. Following these guidelines will help you drive away with confidence, knowing your purchase is protected.

FAQs: Frequently Asked Questions

1. Where can I find a free car installment payment contract template in PDF?

You can find free templates on websites like LawDepot and eForms. However, always review the template carefully and ensure it meets your specific needs and complies with your state’s laws. Be sure to verify the source.

2. Can I modify a car installment payment contract template?

Yes, you can modify a car installment payment contract template to fit your specific needs. However, it’s crucial to ensure that any modifications are legally sound and don’t violate any applicable laws. Seek legal advice if you’re unsure about making changes.

3. What if the buyer misses a payment?

The contract should outline the consequences of missing a payment, which typically include late fees. If the buyer consistently misses payments, the seller may have the right to repossess the vehicle, as outlined in the contract.

4. Is it necessary to have the contract notarized?

While not always legally required, notarizing the contract can add an extra layer of security and can be helpful in case of disputes. It verifies the signatures and confirms the identities of the parties involved. Check your local laws for requirements.

5. What happens if the car is damaged or totaled before the loan is paid off?

The contract will likely require the buyer to maintain comprehensive insurance. If the car is damaged, the insurance company will pay for the repairs. If the car is totaled, the insurance company will pay the lender the outstanding loan balance, and the buyer will likely be responsible for any remaining amount if the insurance payout is less than the loan balance.