The ADP Paycheck Template You’ll Ever Need: A Comprehensive Guide

Navigating the world of payroll can feel like deciphering an ancient scroll. Between gross pay, net pay, deductions, and taxes, the complexities can quickly become overwhelming. Fortunately, ADP, a leading payroll and human resources provider, offers robust solutions to simplify this process. While ADP doesn’t offer a single, downloadable “ADP Paycheck Template” in the traditional sense, the platform provides a comprehensive framework for understanding and managing your paychecks. This guide dives deep into how ADP structures your paycheck information, empowering you to understand every line item and ensuring you’re in control of your finances.

Understanding the Core Components of an ADP Paycheck

The ADP platform, whether you’re an employee viewing your paystub or an employer managing payroll, provides a clear and organized breakdown of your earnings and deductions. Here’s a look at the essential sections you’ll typically find:

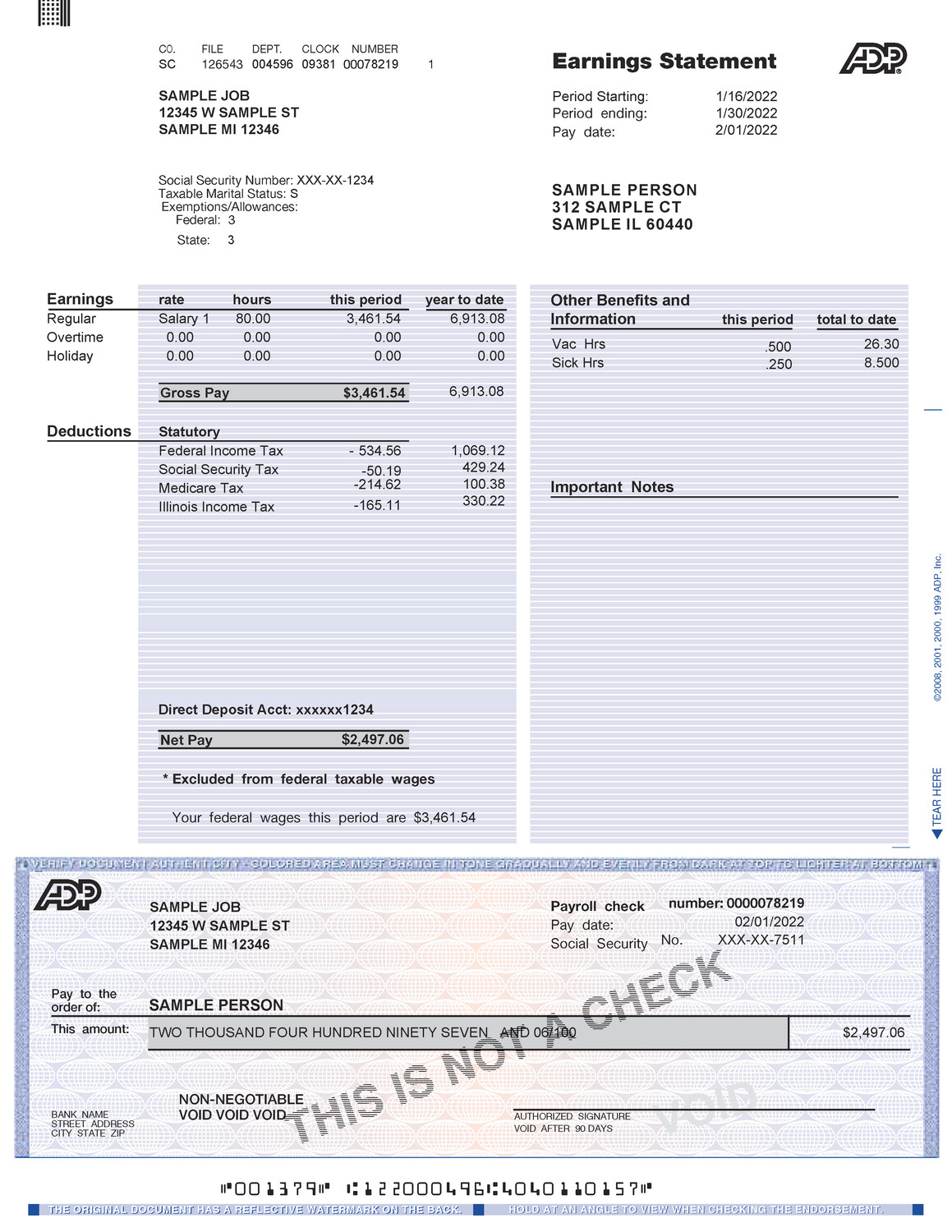

- Employee Information: This section contains your personal details, including your name, address, employee ID, and often, your Social Security number (SSN).

- Pay Period Information: Crucial for understanding the timeframe covered by the paycheck. This includes the pay period start and end dates, as well as the pay date.

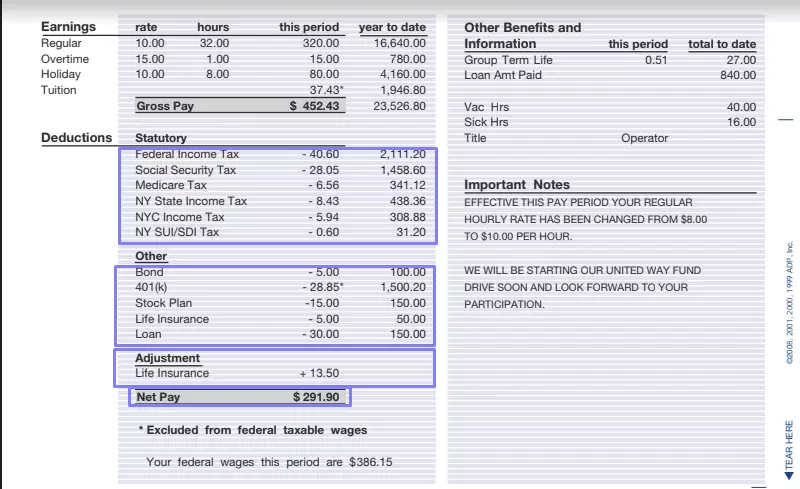

- Earnings: This is where you see a detailed breakdown of your income. This typically includes:

- Gross Pay: Your total earnings before any deductions. This can include:

- Regular wages (hourly rate x hours worked)

- Overtime pay (time-and-a-half or double-time)

- Commissions

- Bonuses

- Tips

- Gross Pay: Your total earnings before any deductions. This can include:

- Deductions: This section details all the amounts withheld from your gross pay. These are categorized and can include:

- Federal Income Tax: Withheld based on your W-4 form.

- State and Local Income Taxes: Withheld based on your state and local tax requirements.

- Social Security and Medicare Taxes (FICA): Mandatory contributions.

- Health Insurance Premiums: Your portion of the cost for health insurance coverage.

- Retirement Plan Contributions (e.g., 401(k)): Amounts you contribute to your retirement savings.

- Other Deductions: This can include things like:

- Life insurance premiums

- Union dues

- Garnishments (e.g., child support)

- Net Pay: This is the amount of money you actually take home after all deductions are taken out. It’s calculated by subtracting total deductions from gross pay.

- Year-to-Date (YTD) Information: This section provides a cumulative summary of your earnings and deductions for the current calendar year. This is invaluable for tax preparation. This includes:

- YTD Gross Pay

- YTD Federal Income Tax Withheld

- YTD State/Local Income Taxes Withheld

- YTD Social Security and Medicare Taxes Withheld

- YTD Deductions (e.g., health insurance, retirement contributions)

- YTD Net Pay

Navigating the ADP Platform for Paycheck Information

Accessing your paycheck information within the ADP platform is generally straightforward. Here’s a quick overview of how you might find your pay stubs, depending on the ADP system your employer uses:

- ADP Workforce Now: This is a popular ADP platform. You typically access your pay stubs through the “Pay” or “Payroll” section. This may involve logging into your account and navigating to a “Pay Statements” or “Pay History” area.

- ADP iPayStatements: This is another common system. You might receive an email notification when your pay stub is available, and you can usually access it directly through a link in the email or by logging into the iPayStatements portal.

- ADP Mobile Solutions: Many ADP platforms have mobile apps, allowing you to view your pay stubs on your smartphone or tablet.

Pro Tip: Always keep your login credentials for your ADP account secure. If you have any trouble accessing your pay stubs, contact your employer’s HR department or your payroll administrator.

Understanding the Significance of Your ADP Paycheck

Your ADP paycheck is more than just a piece of paper (or a digital file). It’s a crucial document for several reasons:

- Tax Filing: Your pay stub provides the information needed to accurately complete your tax return. The YTD information is particularly critical.

- Loan Applications: Lenders often require pay stubs as proof of income when applying for loans or mortgages.

- Budgeting and Financial Planning: Understanding your earnings and deductions allows you to create a realistic budget and manage your finances effectively.

- Verifying Accuracy: Regularly reviewing your pay stubs helps you identify any errors in your earnings or deductions, allowing you to address them with your employer promptly.

Maximizing Your Understanding of Your ADP Paycheck

Here are some tips to get the most out of your ADP paycheck:

- Review Each Pay Stub Carefully: Don’t just glance at the net pay. Take the time to understand each line item, especially deductions.

- Compare Pay Stubs Over Time: Look for trends in your earnings and deductions. This can help you identify potential issues or changes.

- Understand Your Tax Withholding: Ensure your W-4 form is up-to-date and reflects your current tax situation. Adjust your withholding if necessary to avoid owing too much or too little at tax time.

- Keep Your Pay Stubs Organized: Store your pay stubs securely, either digitally or physically, for easy access.

- Ask Questions: If you don’t understand something on your pay stub, don’t hesitate to ask your employer’s HR department or payroll administrator for clarification.

Conclusion: Mastering Your Payroll with ADP

While there’s no single, downloadable “ADP Paycheck Template,” the ADP platform provides a comprehensive and organized way to understand your earnings and deductions. By taking the time to learn the components of your ADP pay stub, utilizing the platform’s resources, and practicing good financial habits, you can gain greater control over your finances and ensure accuracy in your payroll experience. This knowledge empowers you to navigate the complexities of payroll with confidence, making informed decisions about your financial future.

Frequently Asked Questions (FAQs)

1. Where can I find my ADP pay stubs?

The location of your pay stubs depends on your employer’s ADP system. Common methods include the ADP Workforce Now platform, ADP iPayStatements, and ADP mobile apps. Check with your HR department or payroll administrator for specific instructions.

2. What if I see an error on my ADP pay stub?

Immediately contact your employer’s HR department or payroll administrator. Provide them with the details of the error, and they can investigate and correct it if necessary.

3. What is the difference between gross pay and net pay?

Gross pay is your total earnings before any deductions. Net pay is your take-home pay after all deductions (taxes, insurance, etc.) are subtracted from your gross pay.

4. How can I change my tax withholdings?

You typically change your tax withholdings by submitting a new W-4 form to your employer’s HR department. This form allows you to specify the number of allowances you claim, which affects the amount of federal income tax withheld from your paychecks. State withholding forms are used in each state.

5. Does ADP offer a printable paycheck template?

ADP doesn’t offer a downloadable template. Instead, they provide you with access to your existing pay information. You can often print your pay stubs directly from the ADP platform or save them as a PDF file.