The ACORD Certificate Holder: What You Need to Know

Navigating the world of insurance can sometimes feel like deciphering a secret code. One of the most common pieces of documentation you’ll encounter is the ACORD Certificate of Insurance. But what exactly is an ACORD Certificate, and what does it mean to be listed as a “Certificate Holder”? This article will break down everything you need to know about the ACORD Certificate Holder, clarifying its role and importance in the insurance landscape.

Understanding the ACORD Certificate of Insurance

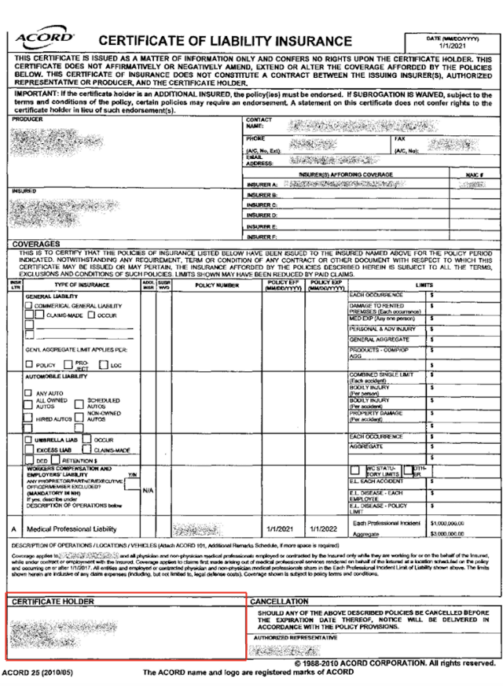

The ACORD Certificate of Insurance is a standardized form, developed by the Association for Cooperative Operations Research and Development (ACORD), that provides a concise summary of an insurance policy’s coverage. It’s a snapshot of the insurance policy, offering key details to third parties who need proof of coverage. It’s not the actual insurance policy itself.

The certificate typically includes information such as:

- Insured’s Name: The name of the individual or entity covered by the policy.

- Insurance Company: The name of the insurance provider.

- Policy Number: The unique identifier for the insurance policy.

- Policy Period: The effective dates of the policy.

- Coverage Types: A brief description of the types of coverage provided (e.g., General Liability, Workers’ Compensation).

- Limits of Liability: The maximum amount the insurance company will pay for covered claims.

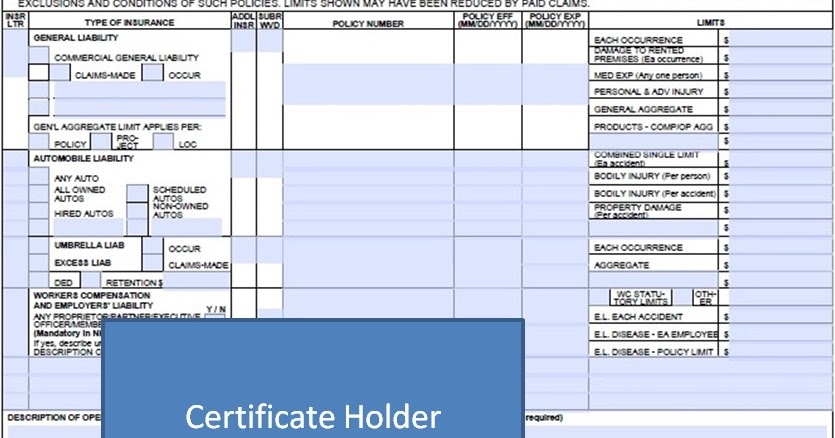

- Certificate Holder: The individual or entity receiving the certificate as proof of insurance.

- Additional Insured: (If applicable) Any party added to the policy granting them coverage under the policy.

- Cancellation Clause: A statement about the insurer’s responsibility to notify the certificate holder if the policy is cancelled.

The Role of the Certificate Holder

The “Certificate Holder” is the individual or entity listed on the ACORD Certificate. They are not the insured party. They are typically a third party who requires proof of insurance from the insured. This means the certificate holder has a vested interest in the insured’s coverage.

Here’s what being a Certificate Holder typically entails:

- Proof of Coverage: The primary purpose is to provide the certificate holder with documented evidence that the insured has the required insurance coverage.

- Notification of Cancellation: The insurance company is obligated to notify the certificate holder if the policy is canceled, non-renewed, or significantly changed. This allows the certificate holder to protect their interests.

- No Direct Claim Rights: The certificate holder does not have direct rights to file a claim against the insurance policy. Only the insured can file a claim.

- Limited Coverage Information: The certificate holder only receives a summary of the policy, not the full policy terms and conditions.

Common Reasons for Being a Certificate Holder

Being listed as a Certificate Holder is common across various industries and situations. Here are some typical scenarios:

- Landlords: Landlords often require their tenants to provide a certificate of insurance, naming the landlord as the certificate holder, to ensure the tenant has liability coverage.

- Contractors: General contractors frequently require their subcontractors to provide certificates of insurance, proving they have the necessary liability and workers’ compensation coverage.

- Lenders: Banks and mortgage companies may require borrowers to provide certificates of insurance for property insurance, protecting the lender’s financial interest.

- Event Venues: Venues often require event organizers to provide certificates of insurance, protecting the venue from liability.

- Businesses: Businesses may need certificates of insurance from their vendors or contractors to mitigate their own liability risks.

Distinguishing Certificate Holders from Additional Insureds

It’s crucial to understand the difference between a Certificate Holder and an Additional Insured. While both receive benefits from the insurance policy, their roles and rights differ significantly.

- Certificate Holder: Receives notification of policy changes and proof of coverage. They do not have coverage under the policy.

- Additional Insured: Is added to the insurance policy and is granted coverage under the policy. They have the same rights and protections as the named insured, up to the policy limits.

The ACORD certificate will clearly identify whether a party is a Certificate Holder or an Additional Insured.

How to Obtain an ACORD Certificate

The process of obtaining an ACORD Certificate generally involves the following steps:

- Request: The Certificate Holder usually requests the insured to provide a certificate.

- Information Gathering: The insured contacts their insurance agent or broker and provides the necessary information, including the Certificate Holder’s name and address.

- Certificate Issuance: The insurance agent or broker completes the ACORD form and submits it to the insurance company for processing.

- Certificate Delivery: The insurance company issues the certificate and sends it to the Certificate Holder, usually electronically.

- Verification: The Certificate Holder should review the certificate to ensure it meets their requirements.

Conclusion

The ACORD Certificate Holder plays a crucial role in verifying insurance coverage and protecting the interests of third parties. Understanding the function of the certificate and the rights and responsibilities associated with being a Certificate Holder is vital for businesses, individuals, and organizations that require proof of insurance. By grasping the intricacies of this essential document, you can navigate the insurance landscape with confidence and ensure your interests are adequately protected.

Frequently Asked Questions (FAQs)

1. What if the Certificate Holder doesn’t receive notification of a policy cancellation?

If a Certificate Holder doesn’t receive notification as required, they should contact the insurance company directly to inquire about the policy’s status. Failure to receive notification is a breach of contract and the Certificate Holder should communicate with the insured to clarify. They may also need to seek legal counsel to protect their interests, especially if they have suffered a loss due to the policy’s cancellation.

2. Can a Certificate Holder make changes to the ACORD Certificate?

No, a Certificate Holder cannot make changes to the ACORD Certificate. The certificate is generated and issued by the insurance company based on the information provided by the insured. Any modifications must be initiated by the insured through their insurance agent or broker.

3. How long is an ACORD Certificate valid?

An ACORD Certificate is typically valid for the policy period listed on the certificate. It is important to review the certificate’s effective dates and expiration date. The certificate should be updated or renewed as the policy renews or changes.

4. What happens if the insured’s insurance policy expires or is cancelled?

If the policy expires, the Certificate Holder is no longer protected and should obtain a new certificate if the insured has renewed their policy. If the policy is canceled, the Certificate Holder should be notified. The Certificate Holder then needs to take action to protect their own interests, which might include requesting a certificate from another source.

5. Is the ACORD Certificate the same as the insurance policy?

No, the ACORD Certificate is a summary of the insurance policy. The actual insurance policy is a more detailed document that outlines all the terms, conditions, and exclusions of the coverage. The certificate provides essential information but does not replace the policy itself.