Platinum vs. Gold Price History: Shocking Trends Investors Wish They Saw Earlier

The precious metals market, a realm of glittering allure and often, perplexing volatility, has long captivated investors. Among the most sought-after assets are gold and platinum, both prized for their inherent value and perceived safe-haven status. However, their price histories tell vastly different tales, with trends that have left many investors wishing they’d had a clearer crystal ball. This article delves into the historical price movements of platinum and gold, highlighting key trends and offering insights that can help investors navigate the complexities of this dynamic market. Understanding these patterns is crucial for anyone considering investing in either metal.

The Age-Old Appeal of Gold: A Steady, If Sometimes Bumpy, Ride

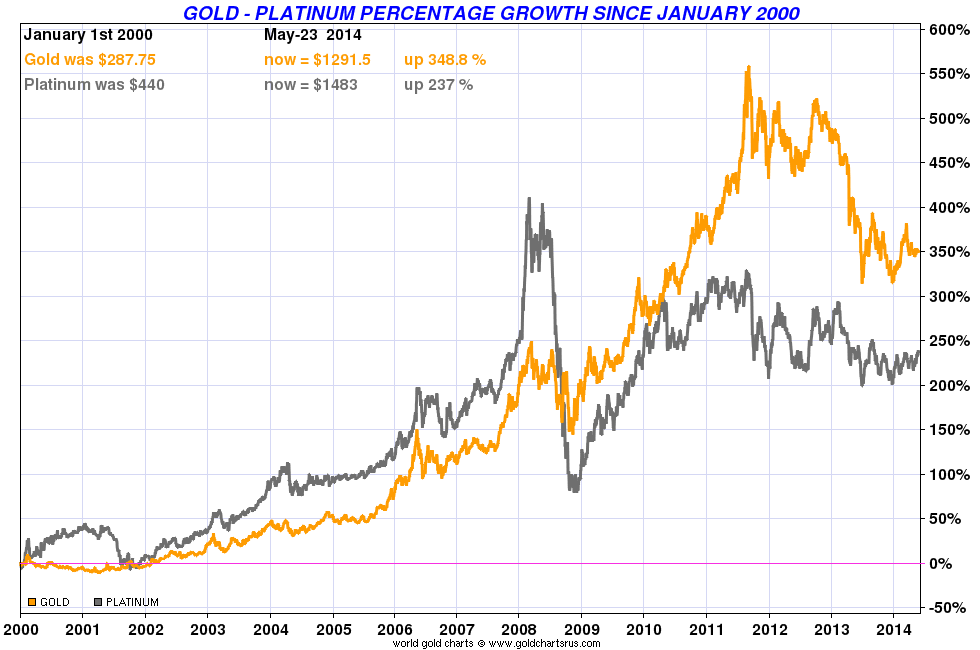

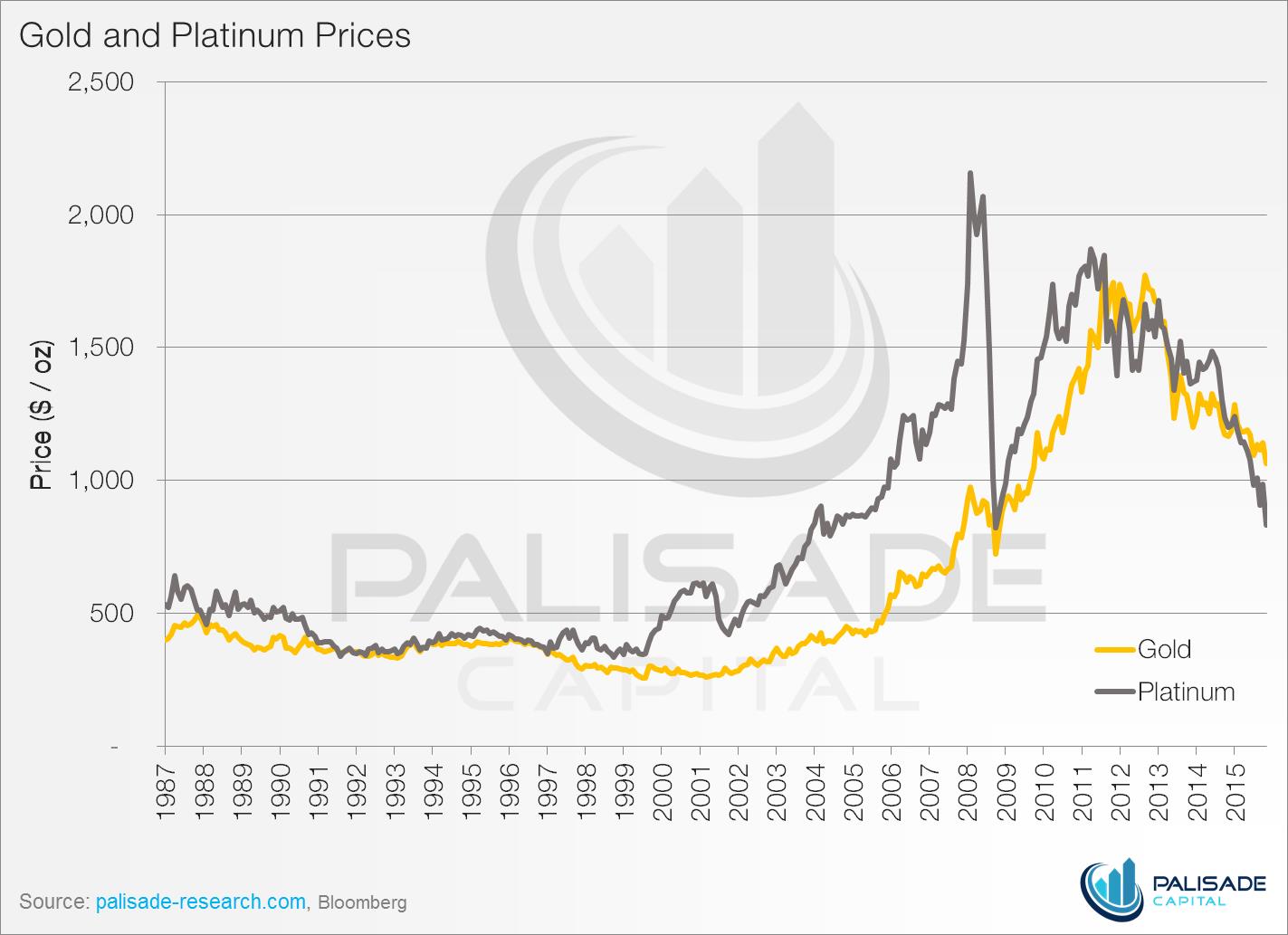

Gold, often considered the cornerstone of the precious metals market, boasts a history stretching back millennia. Its enduring appeal stems from its scarcity, resistance to corrosion, and intrinsic value. Analyzing its price history reveals a generally upward trajectory, particularly over the long term, punctuated by periods of significant volatility.

Key Historical Trends for Gold:

- Inflation Hedge: Gold has historically acted as a hedge against inflation, preserving purchasing power during periods of economic uncertainty.

- Safe-Haven Asset: During times of geopolitical instability or economic downturns, investors often flock to gold, driving up its price.

- Long-Term Growth: Despite short-term fluctuations, gold has shown a consistent trend of long-term price appreciation.

- US Dollar Influence: The price of gold is often inversely correlated with the US dollar; a weakening dollar can lead to higher gold prices.

- Supply and Demand Dynamics: Mining production, jewelry demand, and central bank purchases all influence gold prices.

The 1970s Inflation Surge: The most dramatic price increase for gold occurred during the 1970s. The price of gold experienced a significant surge in the 1970s, rising from around $35 per ounce to a peak of over $850 in January 1980, driven by high inflation and economic turmoil.

Platinum’s Rollercoaster: A Story of Industrial Demand and Volatility

Platinum, a rarer and more industrially-focused precious metal, presents a different picture. While also considered a valuable asset, its price history reveals a far more volatile journey, heavily influenced by industrial demand, particularly from the automotive industry.

Key Historical Trends for Platinum:

- Industrial Dependence: Platinum’s primary use in catalytic converters makes its price highly sensitive to the health of the automotive industry and environmental regulations.

- Substitution Risk: The possibility of substituting platinum with palladium in catalytic converters can impact demand and, consequently, price.

- Supply Constraints: Platinum mining is concentrated in a few regions, primarily South Africa and Russia, making it susceptible to supply disruptions.

- Price Premium Over Gold (Historically): Platinum has often traded at a premium to gold, reflecting its rarity and industrial demand. This premium has fluctuated significantly over time.

- Volatility: Due to its industrial focus, platinum prices have exhibited greater volatility than gold.

The Diesel Engine Boom and Bust: The price of platinum surged in the early 2000s, fueled by strong demand from the automotive industry, particularly for diesel engines in Europe. However, the “Dieselgate” scandal and subsequent shift towards electric vehicles (EVs) have negatively impacted demand, leading to significant price corrections.

H3: Comparing the Trends: Gold vs. Platinum

| Feature | Gold | Platinum |

|---|---|---|

| Primary Driver | Safe-haven demand, inflation hedge, central bank purchases, jewelry demand | Industrial demand (catalytic converters), automotive industry health, environmental regulations, supply disruptions |

| Price Volatility | Generally lower compared to platinum | Significantly higher, driven by industrial cycles and supply/demand imbalances |

| Long-Term Trend | Upward trend, with periods of consolidation and volatility | More volatile, with periods of significant price appreciation followed by sharp corrections, especially influenced by the automotive industry and diesel engine market. |

| Risk Factors | Geopolitical events, economic downturns, US dollar fluctuations, changes in investor sentiment | Automotive industry health, EV adoption, substitution risk (palladium), supply chain disruptions, environmental regulations |

| Premium to Gold | Typically lower, but can fluctuate depending on market conditions and investor sentiment. | Historically higher, driven by its rarity and industrial demand, but the premium can shift dramatically depending on automotive market needs and investor sentiment. |

H3: What Investors Wish They Knew Earlier

Many investors, looking back at the price histories of gold and platinum, express regrets about:

- Underestimating Industrial Demand’s Influence: Particularly with platinum, failing to fully grasp the impact of the automotive industry’s cyclical nature and technological shifts (e.g., the rise of EVs) on demand.

- Not Recognizing the Role of Substitution: For platinum, not anticipating the potential for palladium substitution in catalytic converters, a move that significantly impacted demand.

- Ignoring Market Fundamentals: Over-reliance on technical analysis without considering the underlying supply and demand dynamics, geopolitical factors, and economic conditions.

- Failing to Diversify: Putting too much of their portfolio into a single metal, failing to spread risk.

- Not Staying Informed: Not closely monitoring news and developments in both the precious metals markets, automotive industry, and global economic trends.

Conclusion: Navigating the Precious Metals Maze

The price histories of gold and platinum offer valuable lessons for investors. While gold’s appeal lies in its stability and safe-haven status, platinum’s volatility reflects its industrial dependence. Understanding these contrasting dynamics, recognizing the factors that drive price movements, and staying informed about market trends are crucial for making informed investment decisions. Before investing in either metal, investors should consider:

- Risk Tolerance: Assess your ability to withstand price fluctuations.

- Investment Horizon: Consider your long-term financial goals.

- Due Diligence: Research market fundamentals, industry trends, and geopolitical factors.

- Diversification: Spread your investments across multiple asset classes to mitigate risk.

- Consulting a Financial Advisor: Seek professional guidance to develop an investment strategy tailored to your individual needs.

By learning from past trends and adapting to the ever-evolving market landscape, investors can increase their chances of success in the fascinating world of precious metals.

FAQs

1. What factors primarily influence the price of gold?

Gold prices are influenced by factors such as: inflation, geopolitical events, economic downturns, US dollar fluctuations, central bank purchases, and investor sentiment.

2. What are the main drivers of platinum price fluctuations?

Platinum prices are primarily driven by industrial demand from the automotive industry (catalytic converters), the health of the automotive sector, environmental regulations, supply disruptions, and the availability of substitutes like palladium.

3. Is platinum a better investment than gold?

Neither platinum nor gold is inherently a "better" investment. The choice depends on individual risk tolerance, investment goals, and market conditions. Gold is generally considered a safer asset, while platinum offers higher potential returns but also carries greater risk due to its volatility.

4. How can investors mitigate the risks associated with investing in precious metals?

Investors can mitigate risks by: diversifying their portfolio, conducting thorough research, staying informed about market trends, using stop-loss orders, and consulting with a financial advisor.

5. What is the role of supply and demand in determining the price of gold and platinum?

Supply and demand are fundamental drivers of precious metal prices. Factors like mining production, jewelry demand, industrial consumption, and investor interest all influence the balance between supply and demand, ultimately impacting prices. Any disruption on the supply side or shift in demand can significantly impact the price of gold and platinum.