Is Your Big Lots Comenity Payment Late? Here’s What to Do

Life happens. Bills get missed. And if you’re a Big Lots credit card holder, realizing your Comenity Bank payment is late can be a stressful experience. Don’t panic! This guide will walk you through the steps you need to take to address the situation and minimize any potential damage. We’ll cover everything from understanding the consequences to finding solutions and getting back on track.

This article is designed to provide clear, concise, and actionable information to help you navigate a late Big Lots Comenity payment. Let’s get started.

Understanding the Consequences of a Late Payment

Before you take any action, it’s important to understand the potential ramifications of a late payment on your Big Lots Comenity credit card. Knowing what to expect will help you prioritize and strategize your next steps.

- Late Fee: Comenity Bank will likely charge a late payment fee. The amount will be specified in your cardholder agreement. This fee is added to your outstanding balance.

- Interest Rate Increase (Penalty APR): Your interest rate could increase. Many credit card agreements include a “penalty APR” that’s triggered by late payments. This higher rate can significantly increase the cost of your debt.

- Negative Impact on Credit Score: Late payments are reported to the major credit bureaus (Experian, Equifax, and TransUnion). This negatively impacts your credit score, making it more difficult to obtain credit in the future (loans, mortgages, other credit cards) and potentially affecting your insurance premiums or even employment opportunities.

- Account Suspension or Closure: Repeated late payments, or particularly severe delinquency, could lead to the suspension or even closure of your Big Lots credit card account.

- Reduced Credit Limit: Comenity Bank might reduce your credit limit as a consequence of late payments, limiting your purchasing power.

- Debt Collection: If you continue to miss payments and your account becomes severely delinquent, Comenity Bank might turn your debt over to a collection agency. This can further damage your credit and lead to aggressive collection efforts.

Immediately Addressing Your Late Big Lots Comenity Payment

Time is of the essence. The sooner you take action, the better. Here’s what you should do immediately:

- Determine the Amount Due and Due Date: Locate your most recent statement (either physical or online) to verify the amount you owe and the original due date. This information is crucial.

- Pay the Delinquent Amount: Make a payment as quickly as possible. You can make a payment through the following methods:

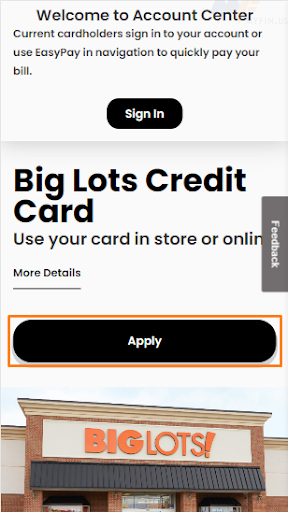

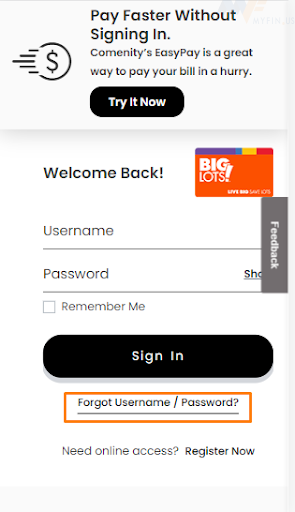

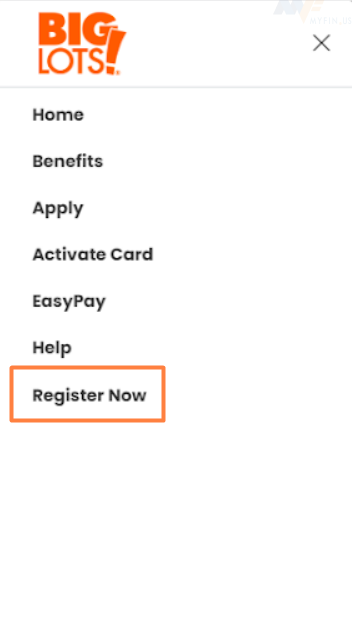

- Online: Log in to your Big Lots credit card account on the Comenity Bank website (https://d.comenity.net/biglots) or mobile app.

- By Phone: Call Comenity Bank’s customer service at the number listed on your statement. Be prepared to provide your account information.

- By Mail: Send a check or money order to the address provided on your statement. Be sure to include your account number. Note: Mailing payments takes longer, so online or phone payments are preferable when you’re late.

- Contact Comenity Bank Customer Service: After making your payment, contact Comenity Bank’s customer service to explain the situation. While they might not waive the late fee, they might be willing to work with you, especially if this is your first late payment. Explain why the payment was late and express your commitment to making future payments on time.

- Set Up Payment Reminders: Prevent future late payments by setting up payment reminders. You can typically do this through your online account or the Comenity Bank mobile app. These reminders will alert you a few days before your payment is due.

Preventing Future Late Payments

Once you’ve addressed the immediate issue, focus on preventing future late payments. Here are some helpful strategies:

- Set Up Automatic Payments: This is the most reliable way to ensure on-time payments. You can authorize Comenity Bank to automatically deduct the minimum payment, or the full balance, from your bank account each month.

- Track Your Spending and Due Dates: Regularly review your credit card statements and track your spending to stay within your budget. Maintain a calendar or use budgeting apps to keep track of due dates.

- Budget Effectively: Create a budget that includes your Big Lots credit card payment. Allocate sufficient funds each month to cover the minimum payment, or ideally, the full balance.

- Consider Using a Payment Calendar: A payment calendar can help you visualize all your bills due each month. This can prevent you from overlooking any payments.

- Explore Payment Options: If you’re struggling to make payments, consider calling Comenity Bank to explore options like a payment plan or hardship program. However, be aware that these options may affect your credit score.

FAQs (Frequently Asked Questions)

Here are some common questions and answers related to late Big Lots Comenity payments:

1. How long does it take for my payment to post?

- The posting time varies depending on the payment method. Online and phone payments typically post within 1-2 business days. Mail payments can take up to 7-10 business days.

2. Will Comenity Bank waive the late fee?

- It’s possible, but not guaranteed. Contact customer service and explain your situation. They may waive the fee, especially if it’s your first late payment and you have a good payment history.

3. How long does it take for a late payment to affect my credit score?

- Late payments are typically reported to the credit bureaus after 30 days. The impact on your credit score can be significant and may last for up to seven years.

4. What if I can’t afford to make the minimum payment?

- Contact Comenity Bank immediately. They may be able to offer a hardship program or payment plan to help you get back on track. Ignoring the situation will only make it worse.

5. How do I dispute a late fee?

- If you believe the late fee was charged in error, contact Comenity Bank’s customer service to dispute it. Be prepared to provide any supporting documentation.

Conclusion

Dealing with a late Big Lots Comenity payment can be a stressful experience, but taking swift and decisive action is key. By understanding the consequences, paying promptly, communicating with Comenity Bank, and implementing preventative measures, you can minimize the damage and protect your credit score. Remember to budget wisely, set up payment reminders, and prioritize on-time payments to maintain a healthy financial standing.